NRIs – Non Resident Indian – by definition, anyone working / staying outside of India for more than 181 consecutive days.

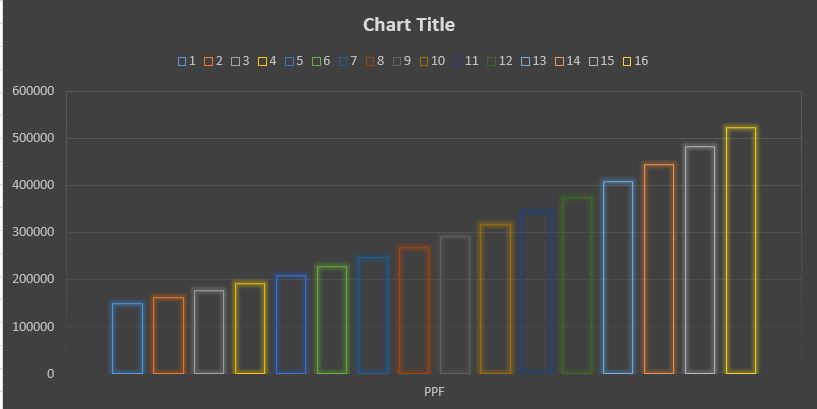

So what are the points an NRI needs to remember while operating a PPF account. The below images shows how with current interest rate of 8.7%, and the maximum deposit of Rs 1,50,000, Over 15 years, an annual contribution of Rs 1,50,000 grows to over Rs 52 lakhs!

1. An NRI can’t open a new PPF Account in India. However, (s)he can maintain the existing PPF Account opened when (s)he was a resident. ie if you are a Resident Indian (RI) and you have a PPF account, you can continue to maintain the PPF account. However, if you have not opened a PPF while you were an RI, then once you get the NRI status, you cannot open a PPF account. It is prudent to have a PPF account because this is one of the few options that gives you tax free returns. While you may have a great prospect outside of India, there could be unforeseen circumstances where you lose your job or due to external political factors you may have to come back to India after a decade or so. Having a PPF account will be beneficial after 15 years because of the power of compounding of interest and the safety that Government of India provides.

2. Payment to PPF existing account: Till 2003, NRIs were not allowed to contribute amount into existing PPF accounts opened when they were resident. However, in 2003, government allowed NRIs to continue investing in existing PPF account (notification (MOF (DEA) No GSR 585 (E) dated 25.7.2003). You need to have an NRO account from which you can make payments to your PPF account. Remember, that once you become an NRI, your bank status also changes to NRI, so remember to update your bank details too.

Advertisement

3. Closure of account : You can not close the account before maturity or until death. Also, after the PPF account matures, NRIs cannot extend the PPF account. It has to be mandatory closed.

4. Withdrawal of Amount: Only possible at maturity. Partial withdrawal is possible, but not preferred. Keep PPF for your retirement. Retirement means living in uncertain times and having a certain/secure fund makes sense for uncertain times.

5. Taxation: No tax on PPF interest or at withdrawal! You may need to pay any tax in the country of residence as per the country’s taxation rules. NRIs are allowed to remit /repatriate upto USD 1 million per financial year from their NRO account subject to certain procedures.

The Author, Krishna Rath, is the founder of finvestor.in a place for financial investors to get their answers on what and where to invest. An avid technologist, Krishna is an MBA from IIM, ALMI from LOMA and is a SEBI Registered Investment Advisor (RIA). He was worked with several financial firms in building critical information systems and now has taken up the challenge to build systems around financial planning for investors.

PPF balance information