Health insurance is often put in the back burner for most Indians. Most the salaried class feel that the company health insurance policy is sufficient. The other set – self-employed or business class seem either have less insurance or neglect it all together, in the assumption that ‘nothing bad will happen’. With the ever rising costs of medical treatment and the increasing probability to fall sick, personal health insurance plans have become a necessity. The solution to the problem of high medical treatment costs is to have a combination of a health insurance plan and a top-up/super-top plan.

This article will explain about Top-up and super top-up plans.

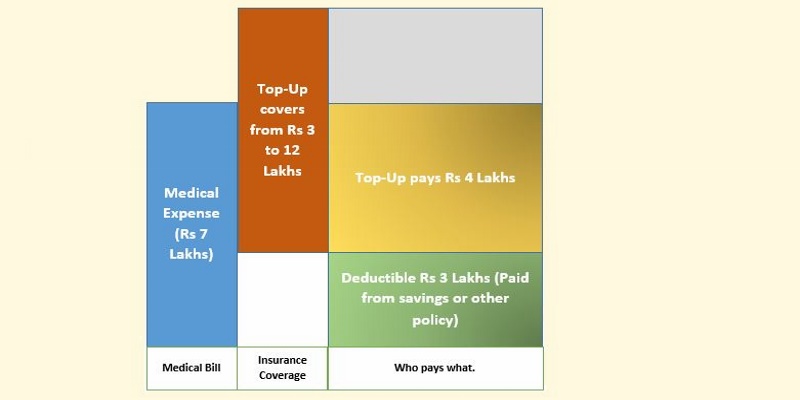

A top up cover will be triggered after a “threshold limit” of a hospitalization expense. Unlike a normal policy that covers you for a hospitalization bill, a top up policy covers the medical expenses after a limit called the deductible.

Example – Assume that you have a top up health cover of Rs 12 lacs sum assured with a deductible of Rs 3 lakhs, (ie the top-up policy will only cover your expenses beyond Rs 3 lacs). If your claim amount is Rs 7 lacs, then it will only pay you Rs 4 lakhs (7 – 3), and not Rs 8 lacs total. That’s the main difference between a regular health cover policy and a top up cover.

So who pays for the first Rs 3 lakhs? Well, that could come from your savings or from your existing health insurance policy. Your existing health insurance policy can be from a company different from the one you plan to take the health insurance from.

Let’s take some more examples

Assume that you already are covered under a health insurance policy, X, for Rs 3Lakhs and you take a top-up, Y, that covers you for Rs 12 lakhs and has a deductible of Rs 3 Lakhs.

Case 1: Claim of Rs 2.5 Lakhs

The bill will be covered by the policy X. The top-up will not be under considered nor can you claim from the top-up since the deductible of Rs 3 Lakh limit has not been reached.

Case 2: Claim of Rs 5 Lakhs

The first Rs 3 lakhs will be covered by policy X and the rest Rs 2 lakh will be covered by policy Y, the top-up plan.

Case 3: Claim of Rs 13 Lakhs

The first Rs 3 lakhs will be covered by policy X and the next Rs 9 lakhs will be covered by policy Y, the top-up plan. The last Rs 1 lakh will have to be borne out of savings.

Advertisement

Super – Top up

A top-up cover will pay you only if your claim amount is for a single hospitalization bill and is above the deductible. Ie if you have two bills that are below the deductible, although the sum of the bills exceeds the deductible, the top-up will still not pay. Ie in the above example is there are two bills of Rs 2.5 lakhs, then the top-up will not pay for the additional Rs 2 lakhs each of the bills are individually not over the deductible.

Super Top-up plans comes to the rescue here. A super top-up plan takes into consideration the total amount of the bills in each year. So, in case you have super top-up plan of Rs 12 lakh with a deductible of rs 3 lakhs, and have two hospitalization claims of Rs 2.5 lakhs in that year, then after the Rs 3 lakhs is covered, either by savings or another policy, the super top-up will cover the remaining Rs 2 lakhs.

Let’s take a few examples to clarify the differences.

Assume that you already are covered under a health insurance policy, X, for Rs 3Lakhs and you either take a

take a top-up, Y, that covers you for Rs 12 lakhs and has a deductible of Rs 3 Lakhs. OR

take a Super-top-up, Z, that covers you for Rs 12 lakhs and has a deductible of Rs 3 Lakhs.

So you either hold policy X & Y or X & Z.

Case 1: hospitalization claim of Rs 7 Lakhs

Top-up case: Policy X will cover for Rs 3 lakhs, and policy Y will cover for remaining Rs 4 Lakhs. Super top-up case: Policy X will cover for Rs 3 lakhs, and policy Y will cover for remaining Rs 4 Lakhs

Case 2: hospitalization claim of two bills each of Rs 2 Lakh

Top-up Policy Case: Policy X will cover for Rs 2 Lakh for first claim, and Rs 1 lakh for the next claim. Now the Policy X, is already exhausted. However, policy Y which is the top-up policy will not pay anything out because none of the individual claims are above 3 Lakhs.

Super Top-up case: Policy X will cover for the Rs 2 Lakh for first claim and Rs 1 lakh for the next claim. Since Super- top considers sum of all claims, therefore the remaining Rs 1 lakh will be

Case 3: hospitalization claim of two bills – Rs 7 Lakh and Rs 1 lakh

Top-up case: Policy X will cover Rs 3 for the first claim. Policy Y, the top-up policy, will cover the next Rs 4 Lakhs. But for the 2nd claim, of Rs 1lakh neither policy X or Y will pay anything.

Super top-up policy case: The policy X will cover Rs 3 lakh for the first claim and Policy Z will cover everything else!

Between Top-up and Super Top-up

One may wonder why then would anyone even for a top-up when super top gives so much more benefits. The only reason could be of lower premiums. And also the probability of you getting into a hospital twice a year is less, and hence it may not make sense to pay the extra premium for a super top-up

Which super top-up policy is the best?

Before we go into which is the best, all top-ups and super top-ups have almost the same rules as that of a normal health insurance policy. Ie, they have the standard exclusion clause list, the waiting period rules, and a claim denial if pre-existing diseases are not reported. So at times, it makes sense to increase the coverage of the existing health insurance policy instead of taking a top-up, because the top-ups would require you to wait for another 4 years before paying for the waiting list category of diseases.

Coverfox.com and policybazar.com can be browsed for all the super top-up plans and top-up plans. Also, to get a good bargain on the premiums, make sure that you deal directly with the insurance company so that you can get a discount on the premiums! Yes, companies do give a discount because associated costs of commissions (as high as 20%) can be saved by the company.

If you are married, it is best to take a family floater plan, so that everyone is adequately covered. Also, remember to take separate policies for parents and in-laws. This will enable you have close a policy in case of unfortunate death of an elderly member in your family.

If you need more specific answers, then we have SEBI RIAs waiting to hear from you. Do post your queries in our free section after your log into finvestor.in.