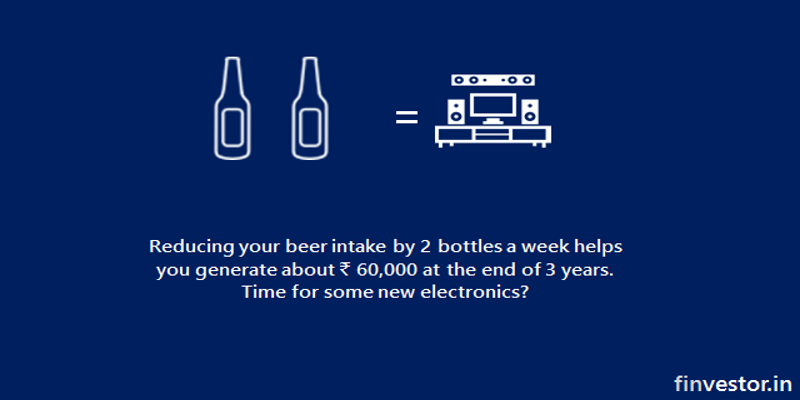

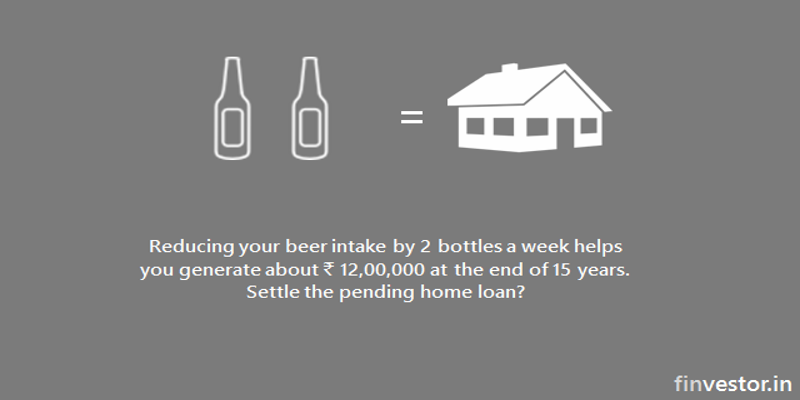

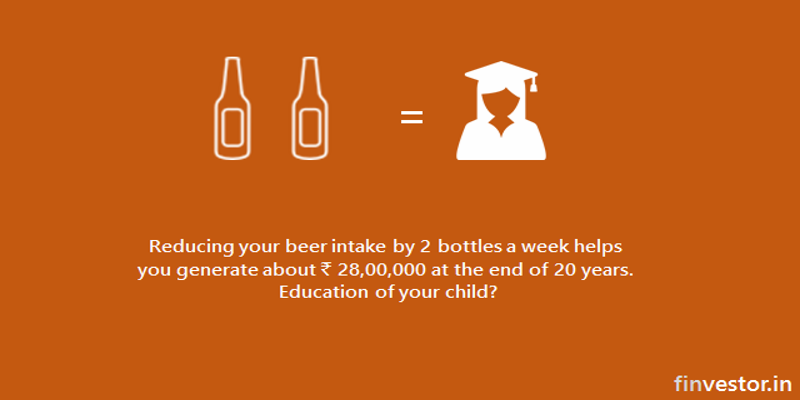

Aha! Misleading title? At finvestor.in, we are on a mission to make investors aware of several pitfalls in investing, and here we are making such ludicrous statements – two bottles of beer is Rs 28 Lakhs! Well, yes, it so turns out that if you save Rs 320 a week and invest that amount in a monthly systematic investment plan of any good diversified equity fund, then you may end up having Rs 28 Lakhs at the end of twenty years.

Watch how two bottles of beer can transform you life!! Please click on https://www.youtube.com/watch?v=6bSAkL6wvHI to watch on Youtube.com

Today, a 650 ml of bottle of beer costs about Rs 160, and with the increasing sales of beer in India, it is evident that beer is replacing aerated drinks as the second most popular drink, water getting the top spot. There is, of course, no harm is having a drink or two, but excessive of anything is bad. Given that most private jobs in India have a life of 10 to 15 years (yes! Including the great Information Technology Industry), it is important for youngsters to save as much as possible in their initial working years. Time is the only parameter in the world that no one can control.

The example of saving Rs 320 is very important in understanding the power of compounding and the value of regular investment. A good equity diversified fund, usually returns about 15% annually. We have generated the 15% value by simulating models across several years – recessionary period, high growth period and lull times. While it may be argued that Indian economy grew very fast in 2005-2008, however, India has still a long way to go when compared to other peers like China. The growth in the economy of the nation is reflected in the growth of equity market and hence the growth in equity funds.

While it may look very positive from a country point of view, not everything will good from an individual point of view. There will be ups and downs in ones careers, there will be that point whether in government job or private job, where a person will stagnate in her/his career, and there could be reasons beyond one’s control to lose a job – such as closure of a company.

Advertisement

Let’s face it, whether you have a secure career with lower job pay, as most of the government employees’ grumble about, or if you have a high paying job to start your career, there is always a time, “now” for investing money. Any money saved and invested in equity over a period of time has historically generated wealth to beat inflation and give multi-fold returns.

Coming to our example, it is clear that the value of compounding will generate great results for any period greater than 10 years, a decade will just fly by! To make this case more interesting, Rs 5000 invested over a period of 10 years in a monthly SIP (15% annual growth) will yield Rs 18 Lakhs, and stretch the investment horizon to 20 years, you will receive Rs one crore. For most people in late 20s and early 30s, if you really want to enjoy your retirement, then the right investment product and disciplined investment will yield the desired results.

Caution – we are taking an assumed increase rate of 15% annually, in equity markets, the values could fluctuate, and hence you can see ups and down in your portfolio. There can be exceptionally great times, where your funds can increase 100% in an year, however such occasions are rare, and they are often compensated by dull or negative growth years.

For optimum performance, investment in Direct mutual funds – ie funds invested directly with AMCs is preferred, as you save on brokerage commissions. Plus never forget that PPF investment, which is about 8% compounded growth and the returns are exempt from tax. Don’t also forget term insurance, that will support your family and loved ones when you are not around.

And if 3 years and 5 years look too far, then drink the two beer bottles to get an instant effect, but lose out on a lot of better deals!

finvestor.in lists SEBI RIA who are experienced and have strong existing client base. Contrary to popular notion of “only rich folks needing a financial planner”, SEBI RIAs serve several middle and upper middle class income group, who have taken advantage of financial planning and generated wealth. Financial advisors are not Portfolio Managers, ie will not take control of your savings/investments, and unlike in TV commercials, they will not come to your home for lunch!