The 2018 Budget has been presented by the Finance Minister, Mr Arun Jaitley. For a working salaried person who pays direct tax and invests in equity shares or equity funds, there is nothing much to cheer about. For pensioners there is something in the budget. Here are the key message for this budget.

-

- No change in tax slabs. – No change in the tax slabs. There was expectation was the tax slabs will be changed, however, nothing of that sort happened. At least, the slabs rates were not hiked.

- Increase of education cess from 3% to 4%. This will hurt your savings. Educational Cess is calculated on your income tax. ie if you have pay Rs 10000 as income tax, then you need to pay 4% over this amount ie Rs 400. This number has been increased from 3% to 4%. It will hurt tax payers in the higher income bracket.

- Reintroduction of Standard Deduction – This is an amount that is deducted from your taxable income. This replaces the transport expenses of Rs 19,200 and medical expenses of Rs 15,000. While this is to reduce the tax liability, it does away with the paper work needed to submit for proofs. The difference of Rs 5800 does not help anyone in the higher tax bracket group.

- Long term capital Gains in Equity Oriented Investments: Last seen in 2004, Long term capitals gain (LTCG) tax was 0% until 31 Jan 2018. Long term for holding equity units is one year. Now, a sale of an equity investment held beyond a period of one year and gains of greater than Rs 1 lakh will be taxed at 10% without any benefit of indexation. However, all equity investments are “grand-fathered” until 31 Jan 2018, which means the base or purchase prices of all your equity shares, mutual funds are assumed to be the highest price of either the purchase of the equity units or on 31 Jan 2018 for purpose of taxation.

- Dividend Distribution Tax: This should not bother an investor as the Mutual fund house will have to bear the DDT of 10%. But investors will be impacted as the AMC pays the tax out of the declared profits and it will reduce the dividends. The move will make many think twice to go in for a Dividend Mutual fund scheme just to get “free” income.

Advertisement

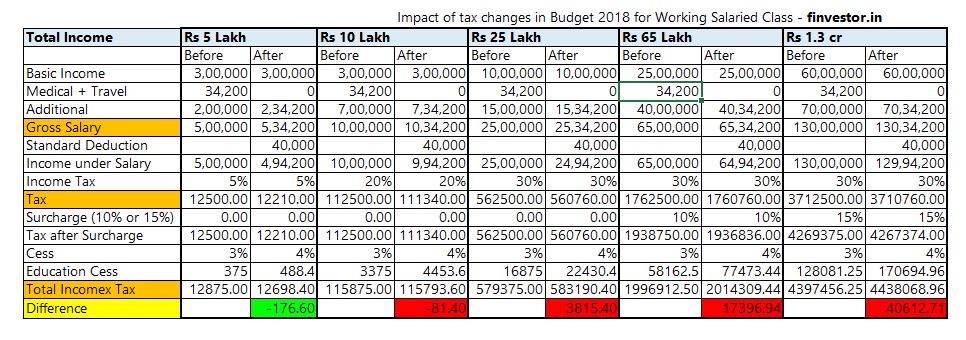

Let’s take a quick look at a few scenarios.

On the income tax, the increase of the education cess and the introduction of standard deduction, will bring no smiles on the tax payers. Higher your income, more will be the outgo of tax.

As you can see from the calculations above, if your Gross taxable salary is Rs Five Lakh, then you can save Rs 176 per year :-). And for an HNI earning Rs 1.3 Cr annually, the hit will be Rs 40,612 annually. Overall, the introduction of the standard deduction and the increase in the cess adds tax liability, however small it may be.

The Long Term Capital Gains tax

While more clarity is awaited on this, here is what we know as of now. The values of your equity investments, stocks or NAVs, will be now taken as if purchased on 31st Jan 2018. Hence, if here are the scenarios

Sale of equity shares of Less than a Lakh

a. Purchased on 2-2-2010 Rs 1,00,000 of X Mutual fund

b. Sold the funds on 2-5-2018 with value of Rs 1,95,000

c. The highest value of the funds between purchase and 31-01-2018 was Rs 1,80,000.

Result – No tax! Because the net gains is less than a Lakh

Sale of equity Shares of more than one lakh

a. Purchased on 2-2-2010 Rs 1,00,000 of Y Mutual fund

b. Sold the funds on 2-5-2018 with value of Rs 2,50,000

c. The highest value of the funds between purchase and 31-01-2018 was Rs 1,30,000.

Result – LTCG is 2,50,000 – 1,300,000 = 1,20,000. Since the first one lakh is excluded, the tax will be 10% on Rs 20,000 ie Rs 2000.

Authour, Krishna Rath is the co-founder of finvestor.in, a listing site for SEBI Registered Investment Advisors, and a financial knowledge website.

Thanks for sharing BUDGET 2018 FOR THE SALARIED CLASS – TAX IMPACT and check here Healforu