Last week, an agent came to me and offered me to purchase Life insurance. When I said, I have term insurance policy, he began to sell me something that would help me – ULIP. I might be an MBA and well-informed about pseudo sciences like NLP, but when I heard ULIP, I could not resist but show an awkward reaction. The sales person noticed it and asked me an expected question –“Sir I am sure you must be having an ULIP”. I nodded. He continued to probe more –“Sir, when did you buy?”. On hearing my answer that it was 9 years ago (2006), he was ready with his well rehearsal speech.

“Sir, last decade, I also admit that many financial companies took customers very lightly, but now IRDA has come up with some extremely strong measures and ULIP is now a much better product….”

I interrupted his sales pitch. I asked him if ULIP suited me – now 35 years old and an entrepreneur (ie job without money!). He was unsure what to reply. I told him that he can continue his sales pitch, but it will be a clear no from me. ULIP does not match my current financial profile. 9 years ago, purchasing a ULIP, which sucked away 30% of my premiums into commission, had already hurt me. It should have given me the returns that were claimed in the fancy brochure. But nothing worked. The ULIP saw the golden boom run of 2006 to 2008 and the gloomy years of 2009 to 2013 and the current bull run. But the NAVs moved up very little. My ULIP now has just reached a break-even point. Disastrous. Had I put that money in fixed deposit, it would have been better. But back then, there was no finvestor.in to advise me!

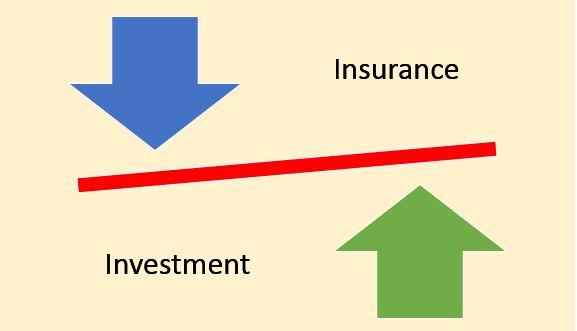

ULIPs now have a better loading (almost 0% commission on premium) that helps customers instead of the agents selling them. Yet, we should be very cautious of this product. First, it’s not to be afraid of ULIPs, but understand that each financial product has a special consumer. As a rule of thumb anyone who is married, has kids or is above say 30 years old, should ideally not take a ULIP. Why? Simple, ULIPs are not pure term insurance, they have a return value. This means that the premiums-rate for ULIPs will be higher. With age comes higher premium. And if you wish to cover your family, you need higher face value and this translates to higher premiums. Oh, and any insurance company you see has a disclaimer “THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLIYCHOLDER”. It’s a double whammy – higher premium rates and risk of wealth erosion. Odd, isn’t it. The risk of investment is on the investor and the insurance company charges you for that risk!

In today’s world, about 1 crore of insurance is a must. This is to ensure that, if god forbids, anything bad happens to you, then your family does not have to suffer. We should also remember that insurance should be purchased after consulting a financial advisor (you can post your query on finvestor.in) because the individual’s assets and liabilities have to be calculated before arriving at the right insurance coverage. Most of the times people get themselves underinsured. A 1 crore insurance from a ULIP point of view will result in huge premiums.

For new age ULIPs, the sum assured is typically ten times the premium. So INR 10,000 per annum will cover you for a Lakh. So if you are expecting a crore of insurance, your premium has to be INR 10 Lakhs! You can get a Crore of insurance for a 30 year old male for about INR 6000 per annum. That is why insurance is best purchased when it is a term insurance policy. Most of the other money making policies don’t act as insurance and are expensive investment. They best serve the agents who sell them. ULIP, if at all taken should be taken when an individual is young, but that’s the time when no one will be willing to pay INR 10 Lakhs for a crore of insurance!

My thumb rule (as being advised by many others) = Term Life Insurance + Personal/family Health insurance (Even if you company offers you a package, Please have your own personal plan) + SIPs in Mutual Funds + PPF + ….(as per your financial needs!)

The Author, Krishna Rath, is the founder of Finvestor.in, a place for financial investors to get their answers on what and where to invest. Krishna is an ALMI from LOMA and is a SEBI Registered Investment Advisor. He has served more than a decade in Information Technology and has designed and developed large scale IT solutions for Financial Companies.