The week of 24 Aug to 28 Aug 2015 just showed how violate the equity markets are. The markets crashed on 24 Aug, Monday on fears of slowdown in China and the rest of the week saw the markets bounce up and down. Investors may have been worried and there is a reason. The equity markets have only two forces – both human – fear and greed. Fear brings the market down and greed takes the market to unexplainable levels.

This post will guide an investor on ways to tackle this situation of whipsaw market movements. These volatile market movements are both concern and opportunity for a trader – someone who is very active in the stocks markets, ie trade daily or deal in futures and options. An investor should take these ups and downs as only market noise, but understand that this is the best for long term investment.

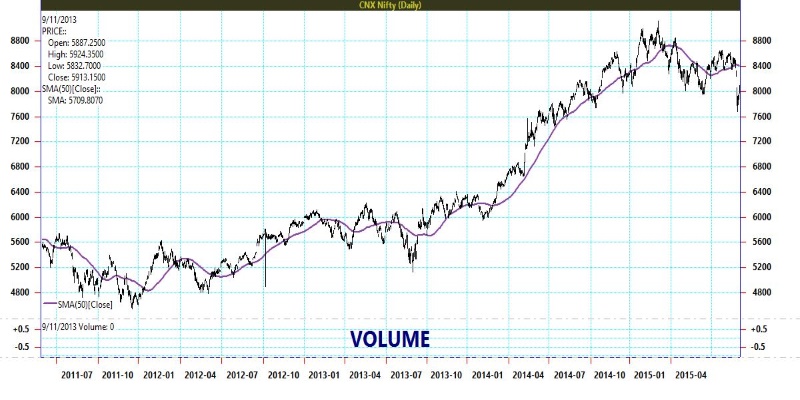

Let’s see how the market has behaved in the last 8 months or so. A snap of the Nifty (the benchmark Index), shows the large and good quality stocks have fared.

The red bars shows the days the market closed below the previous day’s closing price and the green bars indicates that the market went up that day. It is clear from the chart, you don’t need a machine or algo, that the market is trending downwards. The line that crosses over the bars, the 50 day average, is sloping slightly downwards, indicating that the markets are in a mild downtrend. Also, if one observes, the red bars are longer than the green ones – which indicates that when the market goes down, it goes down much more than when the market moves up. So there is more selling pressure. Essentially, there is more fear than greed. The Greece crisis, China growth concerns are causing concerns and spooking the equity markets.

Advertisement

Purely on technical chart, it is clear that the markets will go down a bit before moving up. Why do we say that? If you run a mile, then it likely that you would relax, rest and then take charge again. That’s the same logic for equity markets – If we see from 2013, the markets have risen a lot 5000 levels to 9000 levels. There will be several large players who would like to take profit, and also the markets had risen in expectation of economic development, and hence since much of that did not happen, fear may ensue the 2014 up-move. The chart shows how much Indian benchmark index Nifty has risen.

The markets looks to settle at around 7450 before making the next move up. If 7450 breaks then, we may see lower levels. Why 7450, because that is the levels where the markets found the 50 day support last year. Most traders take automatic trade calls that base on the ‘fundamentals of technical indicators’ – moving average and chart resistance levels.

So what is advice for a financial investor – nothing different from what we have been saying – contact your financial advisor, that too a SEBI Registered Investment Advisor. You can ask about market movements, investment decisions. These are the best days for a long term investor. For someone who is planning to build wealth for the next 10 years or so, start an SIP, systematic investment plan. Having multiple investment days ensures that the market volatility will be taken care of. Remember, that over a long run, equity happens to be the best form of investment, especially for an economy like India. We have a lot to develop in India, billions of FDI is waiting to be poured into India. Ten years ago, many of us could not image that sedans would be common in India, today we see more Maruti Dzires than Maruti 800s. Tomorrow, we could be seeing more SUVs than sedans, ie purchasing power of people will increase and the money flows in economy and making overall economic development.

As per many reports (Report at https://www.valueresearchonline.com/story/h2_storyView.asp?str=25262) , only 2% of Indians invest in equity market. With an economy poised to rise and with technology bringing the equity markets to the fingertips of every Indian, we expect this number to rise. And when it does, the returns expected from the Market is going to be much higher.

Bottom line – Invest regularly, contact a SEBI RIA for unbiased financial advice, ignore the “expert” advice of “sales manager and so called relationship manager” of banks.

A comprehensive plans starts at Rs 12499, Prices will vary based on the premium charged by the RIA listed. More the price, better the attention paid the RIA and better is the quality of service.

The Author, Krishna Rath, is the founder of finvestor.in a place for financial investors to get their answers on what and where to invest. An avid technologist, Krishna is an MBA from IIM, ALMI from LOMA and is a SEBI Registered Investment Advisor (RIA). He was worked with several financial firms in building critical information systems and now has taken up the challenge to build systems around financial planning for investors.