Reproduced with permission from –SEBI RIA, Mr Prakash Praharaj

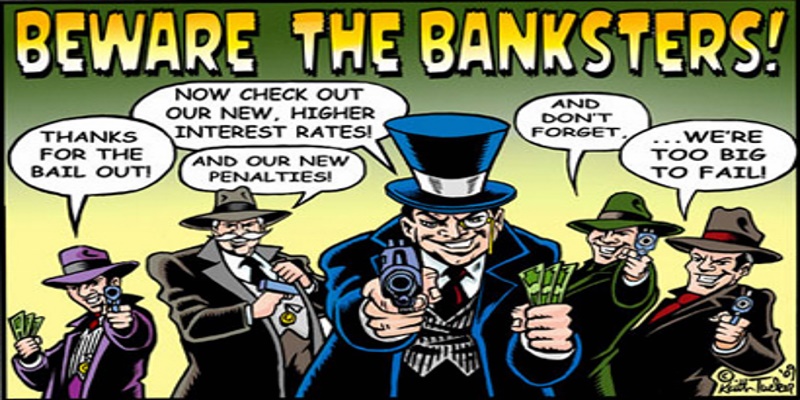

We have to maintain Bank accounts, depend on Banks’ services and trust the Banks staff. But there is a caution; Trust but verify. Now a days, Banks services come loaded for the unsuspecting customers. Recently the service charges in many Banks been increased. If Banks charge for everything under your nose, you have every right to demand to be treated fairly. Caveat Emptor; Buyers be aware goes the maxim.

Here are some specifics;

Home Loan

The home loan is a common experience for many customers. You are offered without a choice to take Life Insurance cover along with home loan. The cover gets gradually reduced with repayments. Banks may also lure you with an offer of a loan for the single premium. But remember that the EMIs get increased due to insurance premium and you have to pay interest on it.

What can you do?

It is better to tell the Bank that you have sufficient Life cover to take care of any untimely demise. If you do not have adequate life insurance cover, you can go for online term insurance and produce a copy of the policy to the Bank with a request not burden with further premium.

Personal Loan

The RBI has directed Banks not to charge a penalty for prepayment of floating rate Home loans but this is not applicable for personal loans. Banks discourage pre-payment of personal loans and impose stiff penalties.Some Banks do not permit to prepay the personal loan before one year.

What can you do?

Think twice on the need to take personal loan and consider all options on cash flow before availing it.

Service charges and Processing fees

The Banks service charges and processing fees have been permitted by RBI to be at the discretion of the individual Banks. Many Banks have hiked it steeply.

What can you do?

You should enquire from your Bank about the details of various service charges. You can visit different Banks in your locality, compare the charges and change the Bank, if possible.

Banks Locker

Your Bank may ask you to buy an Endowment Life Insurance policy or a Mutual Fund for allotting a locker.

What can you do?

Banks charge annual rent for locker and you should demand the service as a Banking customer.You should resist buying Insurance or Mutual funds.

TDS on Bank Deposits

As per recent changes,TDS is deductible from Savings Bank(If Interest is more than Rs10,000/), Recurring deposits and Fixed deposits. Banks may advise you to submit Form 15 G or 15H(Age more than 60 years).But if you are a tax payer, the criminal liability comes on the depositor for submission of form 15G/15H.

What can you do?

Consult a SEBI registered Investment Adviser or a chartered accountant before submitting the Form 15G/H.

Advertisement

Credit Card

Banks often sell credit cards with the promise that for the first year, they will not charge any fee. However, at the end of the first year, the card company sends an innocuous mail stating they will renew the card for a fee unless the customer explicitly rejects it. Even if you ignore this, the annual charges are debited to your account. If you do not pay it, you are reported as a defaulter to credit rating agencies like CIBIL.

What can you do?

- It should advise the credit card issuer that the Reserve Bank of India has banned banks from offering such negative options and take up with RBI, if required.

- You should decline any unsolicited cards.

ATM and Cyber Fraud

Notice of any fraudulent transaction in your account should be immediately reported to the bank. Then the Bank is liable to prove its innocence in e-transaction fraud. If the bank is not notified, the maximum loss to you will be Rs.10000.But Post-notification; the customer is not liable to bear any cost.

*Similar article in the Economic Times on 13thMay 2015

Written by SEBI Registered Investment Advsior, Mr Prakash Praharaj at http://www.maxsecfp.in/component/k2/item/121-customers-of-banks-be-aware

Reproduced with permission from SEBI RIA, Mr Prakash Praharaj

Images Sourced from Google Images (c) to original creator.

About the Author

Shri Prakash Praharaj topped the university during his graduation and post graduation in Commerce and has been awarded two gold medals. By training, he is an MBA and he has been awarded a Diploma in Treasury, Investment and Risk Management besides CAIIB from the Indian Institute of Bankers. He is also a CERTIFIED FINANCIAL PLANNER CM and a Certified Personal Financial Adviser with 30 years of experience in the financial services sector under his belt, which include service at financial sector pillars like the Reserve Bank of India, United India Insurance Company, State Bank of India and SBI Life Insurance Company.

During the year 2010, he promoted Max Secure Financial Planners to provide fee-only financial planning advisory services and promote financial literacy. Today, he is a SEBI-registered Investment Adviser and helps plethora of investors to plan their financial lives and achieve their aspirations.

Mr Praharaj is listed on finvestor.in and you can ask him a query at finvestor.in