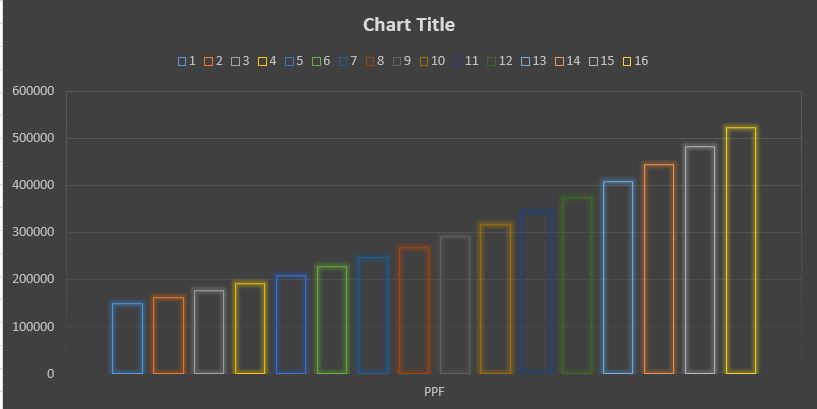

Public Provident Fund (PPF) as a savings instrument needs no introduction —- it is already very popular with the salaried class and the business community alike. The reason why PPF continues to be an instrument in one’s financial portfolio is it’s safety and returns. With current interest rate of 8.7%, and the maximum deposit of Rs 1,50,000, Over 15 years, an annual contribution of Rs 1,50,000 grows to over Rs 52 lakhs!

Opening PPF accounts:

Visit your nearest bank/Post office and To open PPF account you need to fill up PPF Account Opening Form – A and submit at at Bank Branch/Post Office along with the required KYC documents. Some banks also have online PPF scheme opening facility Banks like IDBI Bank, ICICI Bank, offer you to subscribe PPF scheme online

Who can open (eligibility)

Under Public Provident Fund (PPF) Scheme, 1968 a PPF account can be opened by resident Indian Individuals and Individuals on behalf of minor’s child. This means if you already have a PPF account, you can still open one more in the name of your minor child for which you are the guardian.

Also remember that a person can have only one PPF account, and hence both parents cannot open a minor account on behalf of the same child. Only legal gaudrians can open the PPF account for minors. Grand-parents can open a PPF account as guardians of the grand-child only if the parents of the child are not alive.

Also, Hindu Undivided Family (HUF) are not allowed to subscribe to PPF.

Minimum and maximum amount that can be invested under the PPF Scheme.

The minimum deposit amount is Rs. 500 per annum and the upper ceiling limit is Rs. 1,50,000 per annum.

Advertisement

Minimum and maximum amount tenure of PPF Scheme.

Once PPF is opened, it should be kept for a minimum period of 15 years till it matures. After maturity there is an option to extend the PPF account by submitting PPF Continuation Form – H at the branch for any period in a block of 5 years after the minimum duration elapses. You can even retain the account after maturity for any period without making any further deposits. The balance in the account will continue to earn interest at normal rate as admissible on PPF account till the account is closed.

Number of installment for deposit under PPF scheme allowed in a particular financial year

Though more than one deposit can be made in a month, but the number of installment deposits should not exceed 12 in a year. It is best to invest your entire PPF deposit in a single go as early as possible in April of any year. This would ensure that you get the full interest for the year and this helps to build your investment in the long term.

What is the interest rate offered through PPF?

Currently, the interest rate offered through PPF is 8.70% per annum w.e.f. April 1, 2014 which is compounded annually. Interest is calculated on the lowest balance between the fifth day and last day of the calendar month and is credited to the account on 31st March every year.

NRIs and PPF

This will be dealt in a separate post – Part II!

A link for reference: http://www.indiapost.gov.in/ppf.aspx

The Author, Krishna Rath, is the founder of finvestor.in a place for financial investors to get their answers on what and where to invest. An avid technologist, Krishna is an MBA from IIM, ALMI from LOMA and is a SEBI Registered Investment Advisor (RIA). He was worked with several financial firms in building critical information systems and now has taken up the challenge to build systems around financial planning for investors.