Today the markets crashed – well 3% down does not seem bad when considering that we have seen 5% to 10% crashes recently, but in a normal time, anything above 2% is certainly news worthy.

In the last 6 days, the market has declines and eroded 11.3 Lakh Crore of wealth. Today, the markets were stressed right from start and were in red as bearish sentiment prevailed on concerns over rising COVID-19 cases and uncertainty over economic recovery. Sensex closed 1,115 points (-2.96%) down at 36,553 and Nifty finished 326 points (-2.93%) down at 10,805

Before we go to what could potentially happen and what actions need to be done by investors and traders, let us understand what factors contributed to the fall.

Rising COVID19 cases, and talk of lockdowns: India’s cases of COVID19 has been rising sharply. The numbers are staggering, and there are rumours of lockdown – whether localised or full lockdowns. Any talk about lockdowns can cause the markets to spiral down as it means impact to the economy.

No recovery in economy. Everyday some agency or the other is talking about more slowdown and lack of recovery. The growth for India is projected to be negative and the impact to the markets is evident here.

Global markets were down: The world market was down with the same concerns that are listed above – rising COVID19 cases and uncertain economic growth. This led to additional pressure on the market to fall down.

What is in store?

Investors:

For investors, this is an excellent time to add an extra punch into the SIPs – esp in large caps and mid caps. extra punch – additional amount. Of course, all this is based that your own jobs are safe and salaries will be more or less steady.

Historically, if you notice the charts, the recovery from a recession or slowdown is slow – sharp spikes of false optimism get shattered very soon. While it is impossible to determine what levels the markets will bounce back, it is easier to play the SIP game. The market may not rise very soon – it may just loiter around the current levels and fall another 10%, before a 6 to 9 months of lull and then potential rise.

What stocks will rise and what will fall are debates on TV and streets. A well diversified MF and ETF will ensure capital appreciation with less tension of actively monitoring the markets.

Traders

The trend is now negative – so for anytime the market goes up without any reason, that’s the time to sell CE options or sell futures. However, on the monthly view, the plan should be to have an idea of the range for October. while negative , there can be a few days of uptick.

Assuming that the previous prices form a range for us to work on – then we are looking at around 10300 to 11300 range.

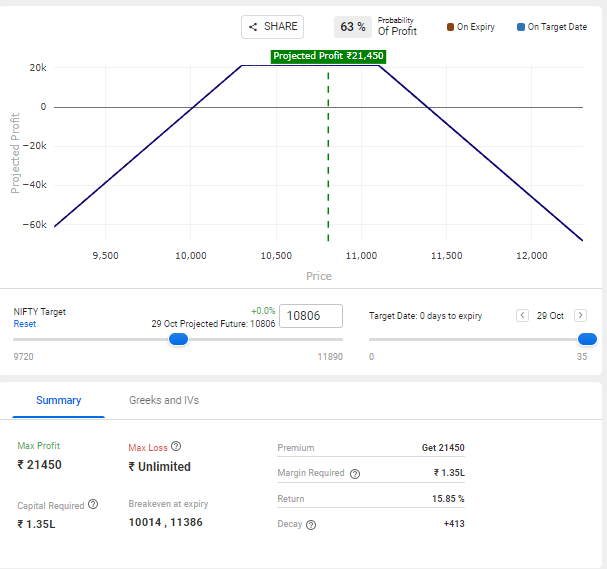

Assuming that we are already seen the worst and the next week’s moratorium verdict is out, and assuming that the area holds – a sell of

- Nifty 11100 CE

- Nifty 10300 PE

Should give good returns. You can protect this with weekly buys of far OTMs. The only risk is the downside – upside rise is highly unlikely. Do a proper risk assessment before entering F&O trades.