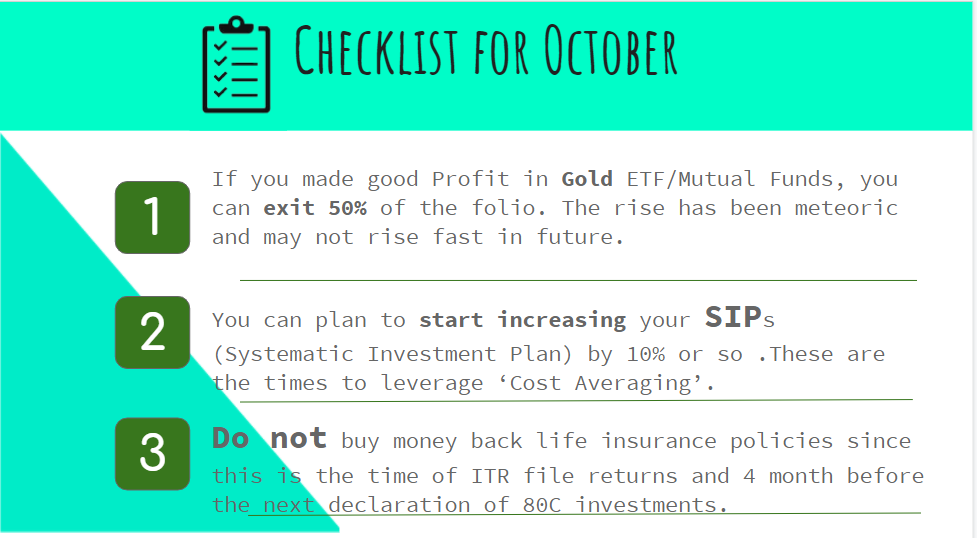

- If you made good Profit in Gold ETF/Mutual Funds, you can exit 50% of the folio. The rise has been meteoric and may not rise fast in future.

- You can plan to start increasing your SIPs (Systematic Investment Plan) by 10% or so .These are the times to leverage ‘Cost Averaging’.

- Do not buy money back life insurance policies since this is the time of ITR file returns and 4 month before the next declaration of 80C investments.