A question that is always in the minds of an investor – is this the best time to invest? The answer is anytime is the best time to invest in equities.

For a moment, let us listen to Macklemore’s song – Good Old Days. One part of the lyrics stands out –

Never thought we’d get old, maybe we’re still young

Lyrics of Macklemore’ Good Old Days from LyricFind (Sourced from Google)

Maybe we always look back and think it was better than it was

Maybe these are the moments

Maybe I’ve been missing what it’s about

Been scared of the future, thinking about the past

While missing out on now

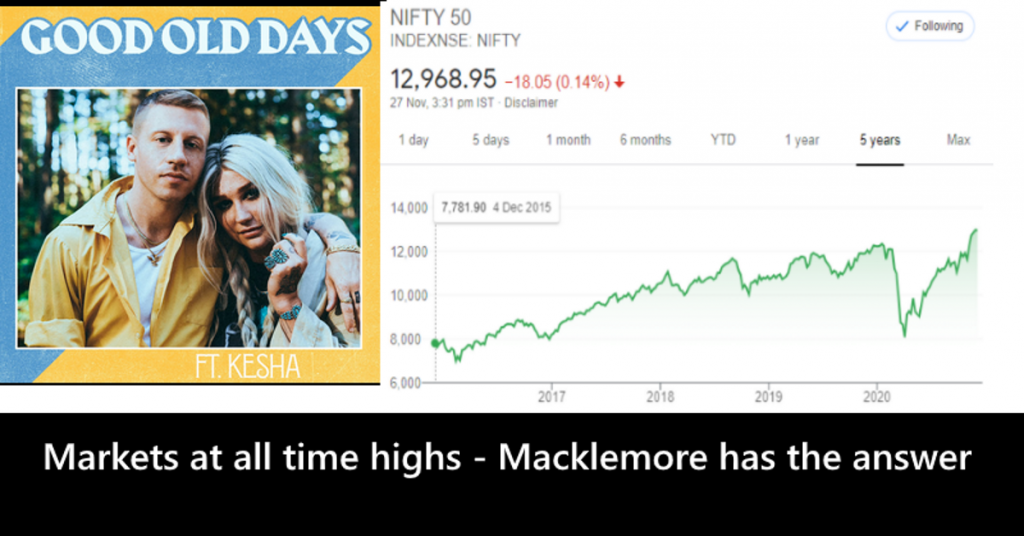

Human nature always believes that we have missed out the good old days. Today as we look back, we always have that feeling that we have missed out the rally, or maybe even leave markets for a while – the days of DD1 and DD2 were so great and wonderful. It just triggers nostalgia – but in actuality, if you were to be in that age again, you would hate that you did not have enough TV channels to view diverse programs. So, today, is what is important and today is what we need to take advantage of.

Coming back to the markets, the simple and proven method in investing in equities is via mutual funds and via SIP. Nothing beats that, and it is even better when you invest in SIP during a bear period. You get better value for the future. Of course, the assumption is that India will grow, maybe not as fast as it did in the past, but markets will grow, stocks will rise and you will get better returns via equity.

The markets are at an all time high – Nifty is breaching the 13,000 mark, Sensex is at 44,000. All big numbers – what does this mean. For an individual investor, it just means that whether you are starting to step into the market or continuing, ensure that you follow the follow key steps

Prefer Mutual Funds and not directly equities

While we have several YouTube videos on success stories of how people turned rich with one stock and also about “10,000 in 1980 would have been 100 crores today”, it is important to note that several of the companies of the past have shut down. It is always better to invest via Mutual Funds, or ETF, so that you don’t have to do the research. Remember, finance looks easy from outside, but portfolio theory, random markets are deep topics and need some expertise.

No Lumpsum

Do not enter in lumpsum in markets, unless you can predict the future. And if you can predict the future, you better be playing SuperLotto, cause you can make better money there. The problem in lumpsum and especially at market high levels is that if there is even a mild (10%) fall in the markets, you lose 10% of your capital, and then emotions run high – that will ultimately lead to you exiting from the markets with a bad experience. So always select SIP route – the markets are not going to run away anywhere and you get better price averages in the 2 to 3 years from SIP route.

No Focus on one AMC

AMC’s have their targets and focus – and how do we know the AMC’s of today are the heroes or the zeroes? We will not. So it is better to say select 2-3 AMCs and a fund each from them. So you have not more than 3-4 funds to monitor.

Never focus on Sectors

Biggest mistake – now pharma is the hot cake – and a year back, it was IT. Sector funds can drag down your portfolio a lot. I never recommend sector funds and this is first in my restructure list. You should always diversify your funds and investment to ensure that market risk is reduced.

Never buy from Bank managers or people selling funds on the streets.

My mother has been cheated several times, and there are forums on Facebook, where daily there are posts where mutual funds have been missold. Bank managers who are trusted custodians of our wealth also have side business – selling mutual funds. Gross misselling happens at Banks. Always do your research before buying an MF.