Mutual Funds can be categorized into three types open-ended, closed-ended, and interval funds, based on the frequency with which unit of the scheme are bought and sold.

A closed ended fund is an equity or debt fund in which the fund house issues a fixed number of units at launch. Once the New Fund Offer period ends, investors cannot purchase or redeem units of a closed ended fund. These are launched via an NFO, traded in the market like stock and have a fixed maturity period. The NAV of the fund determines its actual price, the traded price can be above or below this value depending on the demand and supply of the units. This fund ‘closes’ after the launch period until maturity.

Advantages

Investors cannot redeem their units before the maturity date hence, the fund managers are not worried about maintaining liquidity since there are no redemptions, putting them in a good place to create stability that can help him achieve the investment objectives of the scheme.

The units of closed ended schemes are sold on the stock exchange at prices determined by the demand and supply of the units of the scheme. If the demand for a particular closed ended scheme increases and the supply remains low, then the units can sell at a price much above the NAV of the scheme.

They might seem illiquid since the fund house does not allow redemption the stock exchange offers umpteen opportunities to buy/sell the units. They can be bought or sold from the stock exchange at the existing market prices.

Disadvantages

The fund manager of a closed ended fund is in a good position to achieve the investment objectives of the scheme. Looking at the performance of closed ended funds in the past, it does not reflect better returns as compared to open ended schemes.

One can purchase the units under this scheme only during the initial launch period by making a lump sum investment, thereby increasing the risk. Many investors prefer the SIP approach to investing, it being affordable and spreads the risk.

Investors analyse the performance of a mutual fund scheme over different market cycles to assess if investing in it is a good option. Information is readily available for open ended schemes unlike closed ended funds. The performance of the fund largely depends on the decisions of the fund manager.

Who should invest?

Investors with an investible corpus and an investment horizon in sync with the maturity date of the scheme can opt for it. The risks and returns should be well understood which are given in the offer document.

Tax on Gains

The tax rates depend on the percentage of investments made by the scheme in equity and debt.

- If the fund invests 65% of its total assets or more in equity and equity-related instruments, then it is treated as an equity fund for tax purposes.

- If the fund invests at least 65% of its total assets in debt instruments, then it is treated as a debt fund for tax purposes.

Read the offer document carefully to check the asset allocation that the scheme plans to follow to understand the tax rates.

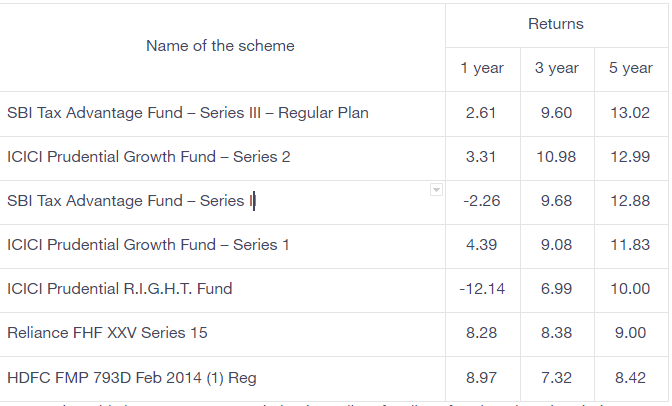

List of Closed Ended Funds in India

(Based on the performance over the last five years):

Remember, this is not a recommendation but a list of well-performing closed ended funds in India.