Who doesn’t want to be a millionaire? Everyone does. Majority of us give up on working towards it by merely sticking to the dream of becoming one. Constant efforts should be made towards the making of this dream a reality by saving more and investing wisely. Once you start doing it, you can turn out to be a millionaire before or by the time you retire.

Financial planning is something that involves management of your hard earned income by spending it reasonably and saving it prudently. It is not at all impossible to become a Millionaire if you start saving at a young age.

The goal of becoming a millionaire can be made easier by following a few steps:

1.Make a budget : The most crucial step is to know about your own financial flowchart. Knowing how much you earn, spend and save,makes a lot of difference. Paying off monthly bills is necessary but keep a track of all the expenses in order to follow the limits set by the budget.

2. Plan and execute: Mere planning is not enough. Once you make a budget,stick to it and always try to adhere to the boundaries defined by it. The savings should be invested and the expenses should never be allowed to go out of control. Technology can come to the rescue. Rule out your goals and use apps to follow them. Investments too should be made knowing your goals first and after doing a proper research.

3.The sooner the better: Start saving at a young age. Do not wait for your salary or income to increase in later years of your life. Set aside a certain sum of money and invest it to fetch returns so as to start generating yields. If you save say Rs.10,000 to Rs.20,000 a month now and increase this amount when you earn more, you may end up having the corpus of Rs. one crore in a 10 to 15 years time by investing the funds to earn say at least 15% CAGR.

Save more if you choose safer investment options,as they give lesser yields or take more risks, invest in more volatile securities however that’s not a suggestible option.Start early with more savings and create a fund of your dreams in a few years time.

4.Spend cautiously : There are many obligations apart from meeting the day to day expenses. Always keep your spending habits under check. Once the track is lost, it will affect the entire planning.

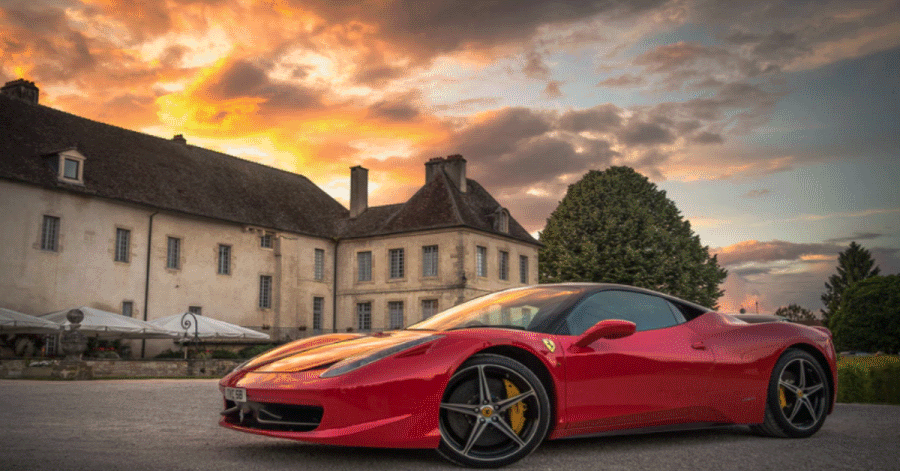

5. Life goals:All of us have different goals at different ages in our life. Substantial savings in the beginning years of your life might get adjusted against housing loans and buying of other assets like a car. Few things are inevitable and we have to make constant efforts to save while taking care of these life goals.

6.Diverify your investments:You can go for more riskier options while you are young. After doing proper research invest in riskier securities to gain more. Losses can be adjusted by adopting prudent investment policies. Direct equities and mutual funds are good options to invest. For safety and stable income purposes do consider fixed deposits. Set aside a certain sum of money for life insurance and health insurance covers. Funds should be well diversified and allocated to take care of all aspects of financial needs.

Financial discipline always counts. Youth today has more information and greater avenues to explore investment options. Understanding the markets and choosing the right kind of investment strategy would serve better in the longer run. Tiny steps taken now can build a huge amount of corpus later. Start early and double your investments by the time you reach a certain age.It is not at all difficult with a well calculated and implemented plan to save your name as a crorepati !