India reported a record rise in COVID-19 infections in the past 24 hours with over 1 lakh cases in a day. Maharashtra, India’s richest state and home to its commercial capital Mumbai and numerous industries, charted 57,074 new cases overnight. However the state announced new restrictions to curb the spread of the virus.

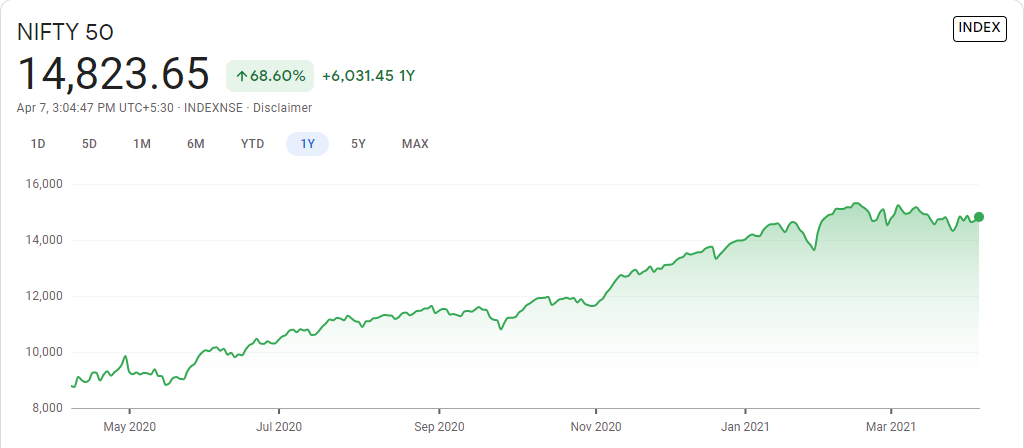

This had a huge impact on the stock market. Earlier this week, financial stocks were under strong selling pressure. The Nifty financial and Nifty Bank indices were down over 3% on Monday and now are bouncing back after a voliate week.

In the morning session on Monday,equity benchmark Sensex tumbled over 1,400 points primarily due to massive losses in financial stocks amid concerns over spiking COVID-19 cases in the country.

If we look at the global scenario, asian stock markets were mixed today after Wall Street hit a record high last week. The S & P 500 index rose close above 4,000 points for the first time. Friday’s job data in the US also was better than expected. The Indian rupee today plunged 73.43 against the US dollar.

The domestic markets have been adversely affected by the gloom-ridden Corona outbreak. There were mixed sentiments in the markets, it opened on a flat note but could not maintain the higher levels and tumbled below 14500.

At the same time, the US markets closed higher as the unemployment rate has fallen to 6%. Asian market was mostly trading in green following the US markets and positive overall sentiments. This could lead to a positive turn resulting into a recovery in the Indian market also and the market can be expected to be in the range of 14350-14900 in the coming week.

Markets got affected by the cases crossing the 1 lakh mark in covid cases in the nation over the weekend. Majority of the numbers are from Maharashtra where 2nd lockdown has been put in place till Apr 30. There is not a complete lockdown and the Market is dependent on Maharashtra’s situation getting better due to the measures taken in the coming days and also in the other 8-10 states especially where the covid cases are rising rapidly.

The month of April is likely to be highly volatile with Q4 earnings, rising covid cases and higher bond yields to determine the trend. The Q4 numbers would start pouring in from mid-April with Infosys and Wipro being among the first ones to declare. Expectations are there for a strong 4QFY21 number for the IT sector and a robust FY22 outlook from the management despite cost pressures. Overall it is believed that IT and Metals are to fare better in comparison to other sectors given the cost pressures faced during the Q4.