‘All that glitters is not gold’ the famous aphorism is going to gain momentum in the current year. It’s time for Silver to shine. The white metal has a bright future not just in 2021 but in another five years as well.

CoronaVirus hit the world badly and prices of Gold also underwent a different pattern due to a fall in its demand. Unlike Gold,Silver is not just meant to be used for making ornaments,it can be used for many other industrial purposes. It does have a better future than Gold because of its dual role and greater volatility.

Global silver demand is expected to rise by 11 percent in 2021 and it is expected to reach an eight year high of 1025 billion ounces.Global jewelry demand is predicted to go upto 174 Moz meaning this shall remain at pre-Covid levels. Silver jumped to $30 an ounce in August-2020 from $18 in January 2020. The investors used stockpiling as a measure to protect their wealth.

The Gold Silver ratio recorded a daily high of 127 in march 2020 and remained at an annual average of 86 to around 68 in 2021. Physical investments are expected to rise to a six year high of 257 Moz.

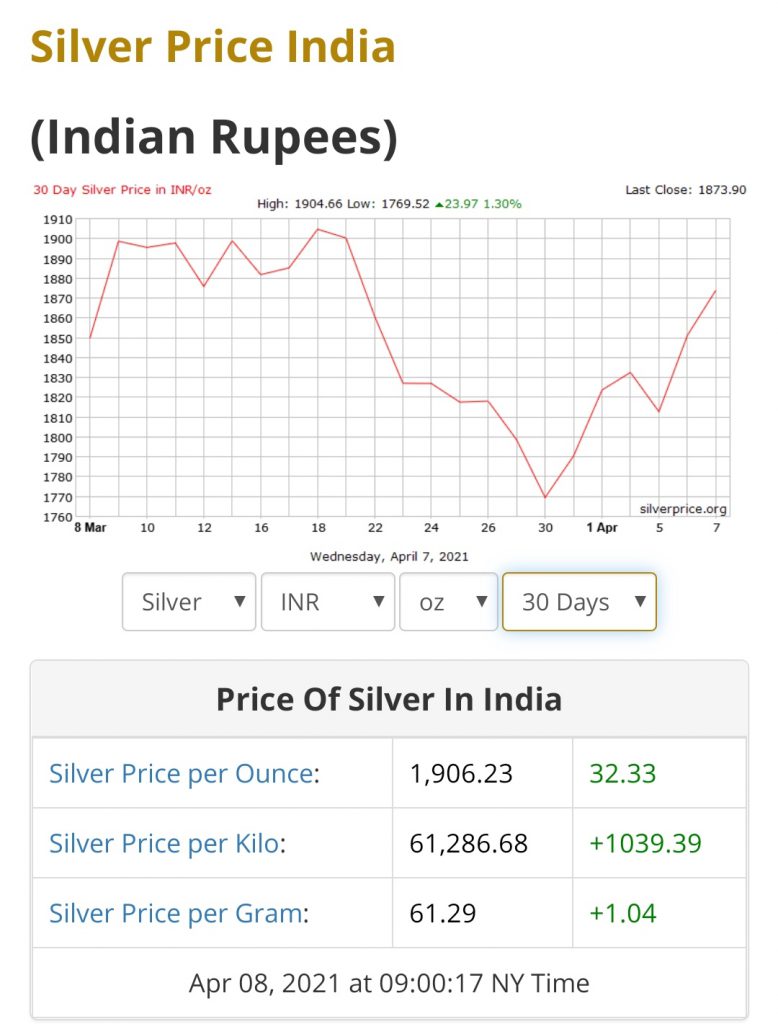

Those who have not been able to invest in precious metals can do it now.Silver futures for May delivery were trading at Rs.66,111 and showed a rise of 0.39 percent.

The U.S. economy shows signs of a very strong recovery post President Joe Biden’s $1.9 trillion Covid aid package. This triggered the bullion’s appearance as a hedge against inflation, Silver may trade with higher volatility as it may find support near Rs.65,500 and resistance at Rs.66,400 according to SMC Global. Many industry analysts forecast that the Silver price will move higher this year and a few say it will remain somewhere around $32 or lower than that.

Silver has comparatively smaller market size and investment in this metal does not need much cash while entering or exiting and hence there is no huge impact on the price of the same. The prices may go high or low considering the fact that the upward and downward trend could be bigger, even more than gold and most other assets.

Understand how Silver Prices behave:

- Demand for Silver and its price move in a similar direction: The demand for Silver has not been affected after the vaccination started all over the world. Investment demand is showing an upward trend and looks genuine. Now if the investment demand continues to rise, so will its price. The demand will stay mostly in industries provided the vaccination drive is successful and the Covid situation is under control putting the economy back to its normal cycles. The investment demand might subside once the Covid Outbreak settles. It might also get affected if the stock market crashes or there is a cumulative recession.

- Silver’s Industrial demand vis vis Supply: Gold cannot be put to many uses but Silver can be. As Silver has industrial applications, demand for it stays stable particularly for those purposes. Much deviation in demand is not possible as long as it is going to be used for its use such as in solar panels, medical applications and electronic components. As there are many countries opting for new PV capacity and Silver’s use in the automotive market too will lead to its demand. 5G technology booming in consumer electronics again looks promising.

Silverware fabrication expects a two digit percentage gain this year. Silver mine production shall recover post re-start of mining activities due to Covid. Silver scrap supply from jewelry and silverware is likely to get recycled for the fifth consecutive year. Metals Focus-the global precious metals research consultancy’s annual report on the international Silver market is to be released on April 22.

But investment demand is altogether different and it would be worthwhile to understand how it works with its price. Whenever there was a demand from investors, the price went high and vice versa. Moreover, what has an impact on Gold, might also have an effect on Silver. Silver prices in our country are dependent upon international prices. It also gets affected by the rupee-dollar relationship. Silver will become expensive if the rupee falls against the dollar and international prices remain stable.

The deflationary forces result in collision. The currencies are inflated to hyperinflationary level by the government and central banks. This affects the future price of Silver. Deflationary forces cannot be changed by the government or the central banks. Crashing of stocks,currencies,bonds,MFs and similar types of investments brings a slight increase in the demand for silver.In a rush to transfer the wealth to only a few, the banks can monetize to inflate and deflate. These factors can push the Silver prices up in the near future.

Considering all the above indications, investing in Silver definitely looks promising.

This article is written by Rupal Vasavada, a financial blogger. She is passionate about writing articles on topics on finance.