The market has been bouncing up and down since the last few weeks. With all the political uncertainty, the chances of the markets falling down is higher.

Here is how I see the Nifty prices.

We are at a critical juncture, if 16800 is broken, we can more selling pressure, and this may continue until 16400. A worst case can be 16000, but that should be out of reach this week.

On the upside 17700 should be crossed with a strong candle that would suggest that bulls are not yet out.

How should you trade tomorrow?

- If SGX and Asian markets open negative, and with Dow futures also being down, it will lead to an increase in the PE prices.

- So should you buy PE or short a 300 deep PE in the expectation that the market may rebound.

- My call would be

- Buy an OTM PE – ie spot – 150 or 200.

- Sell an OTM call – 17700 – do not sell close to ATM as gamma spikes may kill your money

- If market appears to be stabilizing, ie the lows of the days by 2 PM (EU open time) are not breached, the can do a sell of a PE (Deep OTM).

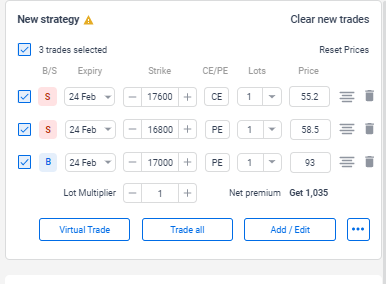

The strategy would look like

(This will not be actual prices as the prices will be reflected real time)

If the markets do not fall, which is the concept of against the trend, it could be as simple as just buying CEs. – For scalps.