Technology has become a powerful force that is reshaping the financial industry. From traditional banking to investment management, technology is driving innovation and transforming the way we interact with money. This article discusses how technology is shaping the financial industry, covering areas such as digital banking, mobile payment systems, automated investment advisors, and blockchain technology.

Online Banking: A Digital Revolution

Online banking has transformed how we handle our finances. In just a few simple steps, we can view account balances, transfer money, pay bills, and even apply for loans. This ease of use has greatly minimized the need to visit banks in person, saving both time and energy.

The rise of online banking has been particularly significant, with millions of people now using digital platforms to manage their money. This has led to increased financial inclusion, as people from all walks of life can now access banking services, regardless of their location.

For example, Priya a schoolteacher in a small village. A few years ago, visiting a bank branch meant losing a day’s wages due to travel. Today, with her smartphone, she can check her balance, pay her child’s school fees, and apply for a loan all during her lunch break. This convenience has replaced time-consuming visits to banks.

Mobile Payments: A Tap Away

Mobile payments have further accelerated the digitalization of finance. With the help of smartphones, we can now make payments with a simple tap or swipe. This has made transactions quicker, safer, and easier to carry out.

Mobile payment apps like Google Pay, PhonePe, and Paytm have gained immense popularity, making it easier for people to send and receive money, pay bills, and shop online. This has also played a key role in expanding the digital economy.

For example, Sunita, a street vendor in Mumbai, uses Google Pay to accept payments. Previously, she relied on cash, limiting her customer base to people carrying exact change. Now, anyone with a mobile payment app can buy from her, boosting her sales and income.

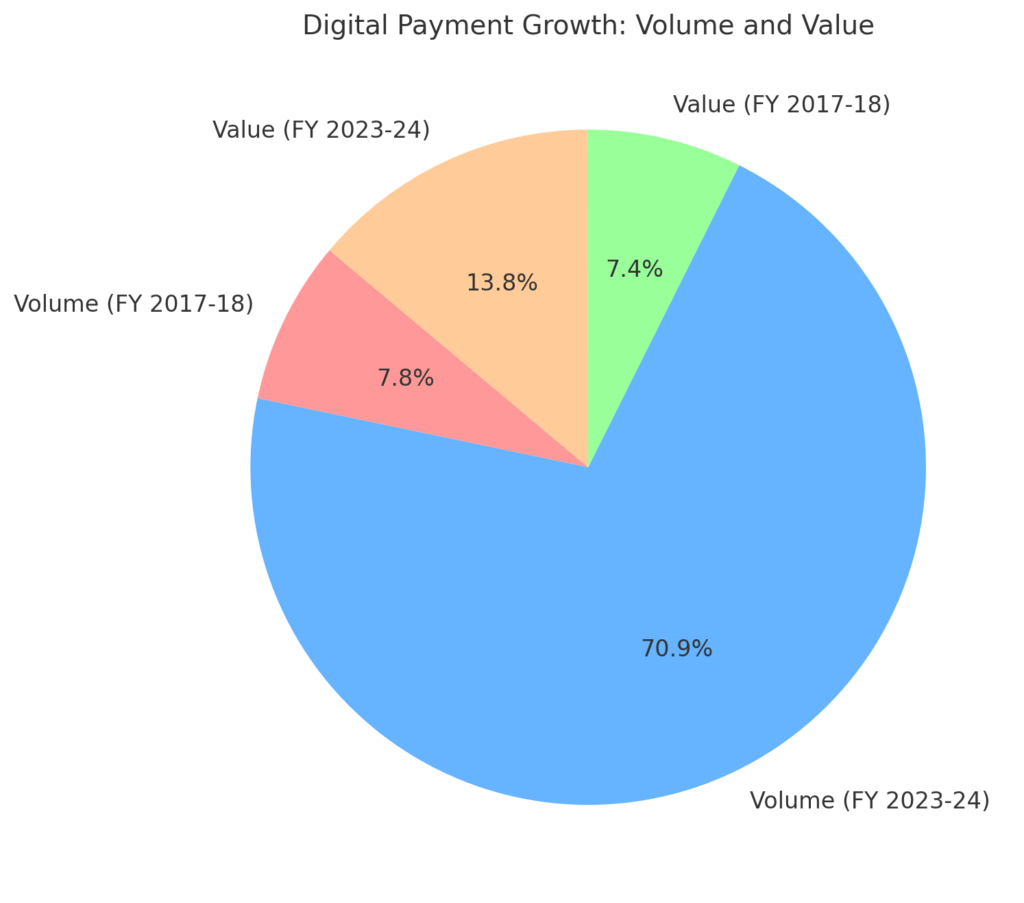

“Growth in Digital Payments: Volume and Value (FY18 to FY24)”

The volume of digital payment transactions increased to ₹18,737 crore in FY 2023-24, up from ₹2,071 crore in FY 2017-18, reflecting a Compounded Annual Growth Rate (CAGR) of 44%. The value of these transactions rose to ₹3,659 lakh crore in FY 2023-24, compared to ₹1,962 lakh crore in FY 2017-18, with a CAGR of 11%.

| Source: Press Information Bureau (PIB) |

Robo-Advisors: Investing Made Easy

Robo-advisors are automated platforms that use algorithms to handle investments. They provide personalized investment guidance and portfolio management services, typically at a much lower cost than traditional financial advisors.

Robo-advisors have made investing available to a broader audience, including individuals who may not have the resources or expertise to hire a personal financial advisor. This has democratized access to investment opportunities and helped people grow their wealth.

Blockchain: The Future of Finance

Blockchain is a distributed digital ledger that tracks transactions across several computers. This technology could transform the financial sector by enhancing the security, transparency, and efficiency of transactions.

In India, the government is exploring the use of blockchain technology for various purposes, including tracking land records, supply chain management, and digital identity. This could have a significant impact on the Indian economy and improve the efficiency of various sectors.

For instance, imagine a scenario where Ravi, a businessman, exports goods to a client overseas. Previously, verifying payments and ensuring document authenticity took weeks. Using blockchain-powered smart contracts, Ravi can now execute these transactions securely and instantly.

The Benefits of Technology in Finance

Technology has brought numerous benefits to the financial world, including:

- Increased Efficiency: Automation and digitalization have streamlined financial processes, reducing costs and improving efficiency.

- Enhanced Security: Technology has made it easier to protect financial data and prevent fraud.

- Improved Customer Experience: Digital platforms offer personalized services and 24/7 access to financial information.

- Financial Inclusion: Technology has made it easier for people from all backgrounds to access financial services.

- Innovation: Technology is driving innovation in the financial industry, leading to the development of new products and services.

Challenges and Risks

Although technology has brought numerous advantages, it has also created new challenges and risks, including:

- Cybersecurity Threats: As financial transactions move online, the risk of cyberattacks increases.

- Data Privacy Concerns: The collection and storage of personal financial data raise concerns about privacy and security.

- Digital Divide: Not everyone has access to the technology needed to participate in the digital economy, leading to a digital divide.

- Regulatory Challenges: The rapid pace of technological change poses challenges for regulators who need to keep up with the latest developments.

Conclusion

Technology is changing the financial landscape faster than ever before. By embracing innovation and addressing the challenges, we can harness the power of technology to create a more inclusive, efficient, and secure financial system. As we move forward, it is essential to strike a balance between technological advancement and human values, ensuring that technology serves the best interests of society.