Mutual Funds can be categorized based on their structure into three types open-ended, closed-ended, and interval funds. Open ended mutual funds are the most common and popular among investors.

When we say mutual funds, we mean open ended mutual funds. The units of open-ended funds are not traded on the stock exchange. There is no limit on the number of units that the fund can issue. Investors can purchase or redeem units from the fund house on any working day at the existing NAV of the scheme, which is determined by the performance of the underlying securities of the fund. These schemes do not have a maturity period.

Advantages

1.As an investor, the units of an open-ended fund can be redeemed on any working day, adding the necessary component of liquidity to investment portfolio. While there are many investment options available offering good returns, many of them have a lock-in period which renders money illiquid until maturity. With open ended mutual funds, one can enjoy maximum liquidity.

2.Since investors can purchase or redeem units from the fund house in an open-ended fund, a quick glance at the historical performance of the fund can offer a glimpse into how it has performed across different market cycles. This helps in making an informed decision and invest.

Since purchase units can be purchased on any working day, a systematic investment plan or SIP to invest a fixed amount in the scheme on a regular basis can be set up. This is particularly beneficial for salaried investors and people without an investible corpus on hand. Investing via SIP can help build a corpus from scratch.

Disadvantages

The NAV of an open-ended mutual fund fluctuates according to the performance of its underlying securities. Open ended funds are prone to market risks and highly volatile in nature. While the fund manager endeavours to contain the volatility by diversifying his investments, these funds carry a certain degree of market risks at all times.

Who should invest?

Open Ended Funds form the biggest part of the mutual fund market. Therefore, most investors can invest in open ended funds. What they need to keep in mind is to invest according to their financial goals, risk tolerance, and investment horizon.

Tax on Gains

Gains on mutual funds are taxed. Also, debt and equity funds have different tax rules and rates. In the case of Open-Ended Mutual Funds, the tax rules and rates vary with the percentage of investments made by the scheme in debt and equity.

- If the fund invests 65% of its total assets or more in debt instruments, then it is treated as a debt fund for tax purposes.

- If the fund invests at least 65% of its total assets in equity, then it is treated as an equity fund for tax purposes.

Read the offer document carefully and check the asset allocation that the scheme plans to follow to understand the tax rates.

List of Open-Ended Funds

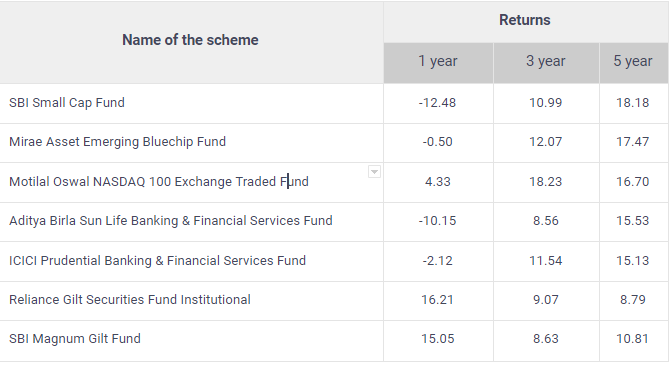

Based on past 5 years performance here is the list of best open ended mutual funds in India 2019

Invest according to your risk and investment profile, please do not take the above as the final recommendation.