The RBI observed Financial Literacy Week in February to promote financial education.

One needs to be financially literate to take care of One’s own bills. To borrow and save money needs disciplined behaviour in financial terms. Managing your own money needs a fundamental understanding of personal credit and taking responsibility to pay your dues.Make a budget, save and protect your savings. Understand the need to balance your expenses against your income.

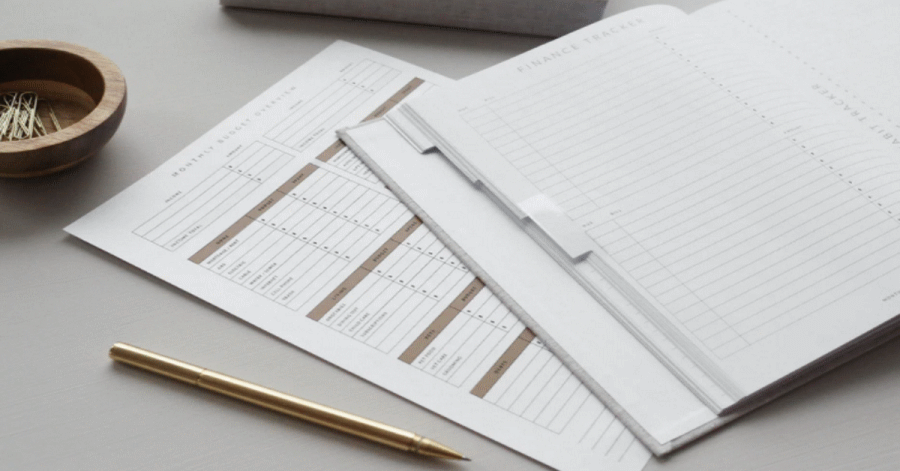

Here is a guide to managing personal finance:

- Prepare a budget-By preparing a budget, an exact idea of income and expenses can be gathered. Payment of regular and other likely expenses are provided for in the budget against the income. By doing so we can be sure about how much is left to pay off the debts and the rest can be available for saving. We usually do not resort to making budgets for our personal use. But it is inevitable to not only make a budget but regularly follow it in order to maintain an equilibrium in finances.

- Get an idea of the expenses-Both the cash and credit card bills matter. If expenses are not checked, they may go out of control. Regular expenses should be met but a habit to let them go out of track is not a welcome approach.

- Use of discounts and cashbacks- One of the ways to better manage expenses is to find whether any discount or cashbacks are available while making payment for any particular product or services. Regular purchases and timely payments allows one to get such offers. This can help reduce your expenses.

- Savings-What is left after paying off your regular bills and debts is available for savings. The money saved would be of greater help in case any unforeseen events take place. To meet any extraordinary and unexpected circumstantial losses, savings are the only remedy we can look upto.

- Debt repayment discipline-To pay off one’s debt is a major financial responsibility. Be it any kind of loans or credit card bills, there should be no default while repaying them. The financial stress and better money management need a disciplined pattern while paying off debts.

- Maintain your credit score- Maintaining a good credit score could be helpful to arrange for finances for a longer term on favourable conditions. Paying off your bills regularly has a positive effect on your credit score. Credit score shows one’s creditworthiness. Paying off debts eases the release of other loans etc.

- Avoid a lavish life for the sake of society- Do not fall into any trap like a social pattern ‘to live life in a certain way’. Money is earned with great efforts. Reward yourself only when you successfully save more than what you expected for. Without meeting the targets, merely for the sake of what friends and the society believe, don’t get inclined to spend unnecessarily.

- Get involved in financial literacy- Money matters are worth paying attention to. There are a number of changes happening in the economy, markets, business and industries. The Government also makes various rules and brings in laws to either levy taxes or release curbs in a certain way. Pay attention to the changes taking place in the money market. They affect your own accounts too.

- Review your financial goals periodically-Personal budget, available funds etc. do not remain the same over a period of time. The income and expense ratios also change. When you have some goal in your mind, you have to make adjustments into your finances accordingly. Buying a small pot would not involve any major planning but buying a house property would have a lot to do with it. So, a plan made once cannot be of help forever. It should be reviewed from time to time and all the required changes should be brought about to make it worthwhile.

Image: https://unsplash.com/@northfolk