Gold has long been a symbol of wealth and stability, sought after for its intrinsic value and historical significance. Investing in gold can be a smart way to diversify your portfolio and protect your wealth against economic uncertainty .Understanding the different ways to invest in gold can help you make informed decisions to protect and grow your wealth.

Level Up Your Portfolio: Exploring Ways to Invest in Gold

Gold has always held a special place in our world. Not only is it beautiful, but it’s also a way to invest your money and potentially grow your wealth. If you’re thinking about adding some golden sparkle to your portfolio, here’s a breakdown of different investment options:

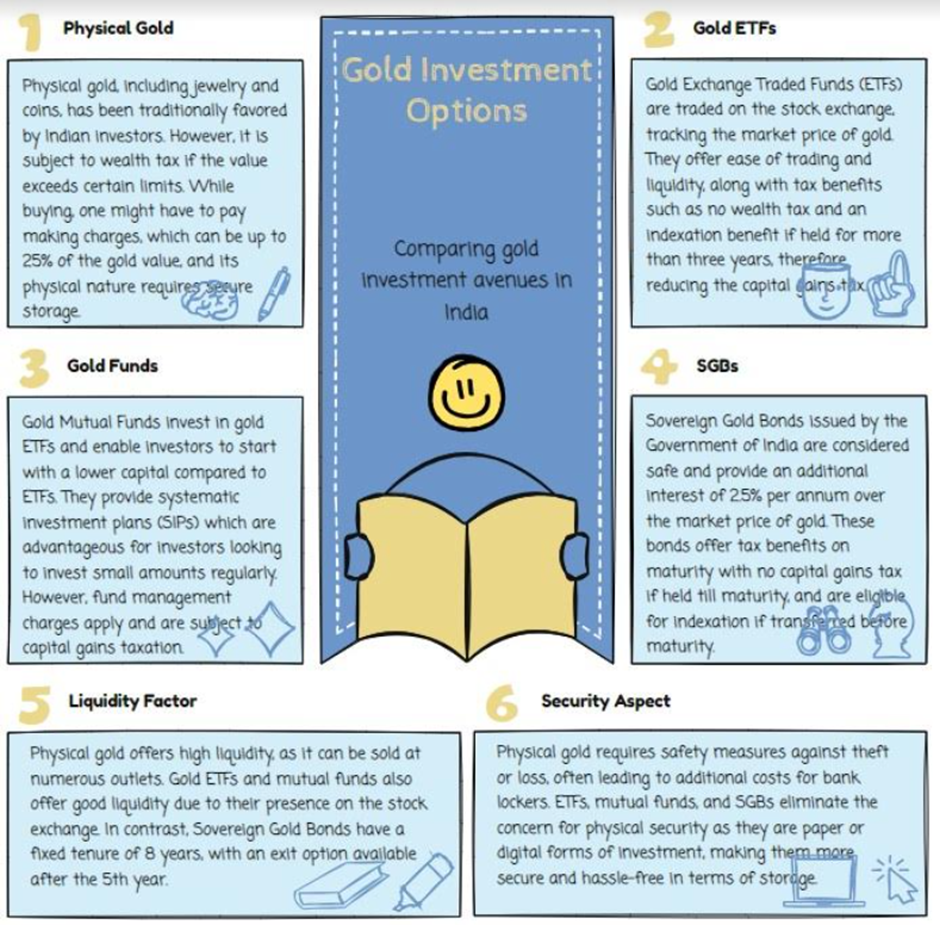

1.Physical Gold:

- This is the classic way of owning gold. You buy it in the form of jewelry, coins, or bars.

- Example: You visit a jeweler and purchase a gold necklace for ₹20,000. The value of the necklace is tied to the weight of the gold it contains and the current market price of gold per gram.

2. Gold ETFs (Exchange Traded Funds):

- Imagine a company that buys physical gold and then issues units (like shares) representing that gold. That’s a Gold ETF! The price of each unit reflects the price of the underlying gold.

- Example: You invest ₹10,000 in a Gold ETF, and for that amount, you get units representing a small amount of physical gold. If the gold price goes up, the value of your units goes up too.

3.Gold Mutual Funds:

- These are mutual funds that invest a majority of their money in Gold ETFs or gold mining companies. They are managed by professionals who make investment decisions.

- Example: You invest ₹5,000 in a Gold Mutual Fund. The fund manager uses that money (along with money from other investors) to buy Gold ETFs or shares of gold mining companies. The value of your investment depends on the performance of those holdings.

4. Sovereign Gold Bonds (SGBs):

- These are government-backed bonds issued by the Reserve Bank of India (RBI). They are essentially like buying gold from the government with a promise of guaranteed returns.

- Example: You invest ₹10,000 in an SGB offering a 2.5% annual interest rate. You get the benefit of gold price appreciation along with a fixed yearly interest payout from the government.

Gold Investment Options: A Quick Comparison Chart

| Investment Option | Description | Pros | Cons | Minimum Investment |

| Physical Gold | Owning actual gold bars, coins, or jewelry. | Tangible asset, control over ownership | Storage costs, security risks, resale hassle, making charge (jewelry) | Varies depending on the size and form (e.g., a small gold coin vs. a large bar) |

| Gold ETFs (Exchange-Traded Funds) | Invest in fractions of gold bullion traded on stock exchanges. | Affordable, transparent pricing, liquid | Don’t own physical gold, fees | Typically lower than physical gold (may vary depending on the ETF) |

| Gold Mutual Funds | Professionally managed funds investing in gold and gold-related assets. | Diversification, professional management | Fees, less control over investments | Varies depending on the fund |

| Sovereign Gold Bonds (SGBs) | Government-backed bonds tied to gold price. | Safe, guaranteed interest, potential tax benefits (in some countries) | Lock-in period, may not see significant gains if gold price falls | 1 gram of gold |

Here are some gold funds in India:

Given the current market conditions, here are some gold funds that you might want to consider for investment:

- Axis Gold Fund

- HDFC Gold Fund

- SBI Gold Fund

- Aditya Birla Sun Life Gold Fund

- ICICI Prudential Regular Gold Savings Fund

- Kotak Gold Fund

- Nippon India Gold Savings Fund

- Quantum Gold Fund

- UTI Gold Exchange Traded Fund

- IDBI Gold Exchange Traded Fund

What Documents do you need to Invest in Gold?

The documents you need to invest in gold depend on the method you choose:

Physical Gold:

For small purchases (under ₹2 lakh ) typically no documentation is required.

For larger purchases (over ₹2 lakh ), you might need to provide identification proof like Aadhaar card, PAN card, or passport.

Gold ETFs, gold mutual funds, and sovereign gold bonds

These all require opening an account with a financial institution. This usually involves a process called Know Your Customer (KYC). Here’s what you’ll likely need:

KYC form: This form collects your personal and financial information for verification.

Identification proof: Same as for physical gold purchases (Aadhaar card, PAN card, etc.).

Address proof: Documents like utility bill, bank statement, or rental agreement can be used.

PAN card: This is a unique identification number required for many financial transactions in India.

Bank account details: This is needed for transferring funds for your investment and receiving any returns.

Additional Notes:

Specific requirements might vary depending on the financial institution you choose.

It’s always best to check with your chosen broker or investment platform for their specific document requirements.

Why Should you Prefer Investing in Gold?

Think of gold like a superhero cape for your savings! Here’s why:

Imagine you save ₹100 for a new video game. But a year later, the game might cost ₹120 because of inflation (prices going up slowly). That’s where gold comes in. Gold usually keeps its value over time, like a superhero cape protecting your money from inflation’s punches. So, if you invest ₹100 in gold today, it might still be worth close to ₹100 (or even more) in a year, even though other things cost more.

Gold can also be a calming friend for your investments. Picture this: during scary economic times, people might rush to buy gold because they see it as a safe choice, like a superhero with super strength. This can make the price of gold go up, and you might end up earning a profit on your gold investment. So, gold can add a shield of stability to your portfolio, protecting it from some of the bumps along the investment road.

Key Risks of Investing in Gold

Understanding these risks can help investors make informed decisions and manage their gold investments effectively.

| Type of Gold Investment | Key Risks |

|---|---|

| Physical Gold | – Storage and insurance costs |

| – Risk of theft or damage | |

| – Limited liquidity, especially for large quantities | |

| – Counterfeit risk | |

| – Market value depends on purity and weight | |

| Gold ETFs | – Price volatility and market risk |

| – Dependency on gold prices and ETF performance | |

| – Counterparty risk | |

| – Liquidity risk | |

| – Tracking error (ETF may not perfectly track gold prices) | |

| Gold Mutual Funds | – Market risk (fluctuations in gold prices) |

| – Fund management risk (quality of fund management) | |

| – Regulatory risk (changes in regulations affecting funds) | |

| – Redemption risk (difficulty in selling fund units) | |

| Sovereign Gold Bonds | – Interest rate risk (changes in bond interest rates) |

| (SGBs) | – Liquidity risk (may not be easy to sell before maturity) |

| – Market risk (fluctuations in gold prices) | |

| – Credit risk (government may default on bond payments) | |

| – Opportunity cost (loss of potential returns from other investments) |

Taxation of Gold Investment Options

Taxes on gold investments can vary depending on the type of gold you choose and how long you hold it (investment period). Here’s a breakdown for the most common options in India:

Physical Gold:

Short-term (less than 3 years): Gains are taxed according to your income tax slab (the higher your income, the higher the tax rate).

Long-term (more than 3 years): Subject to a 20.8% tax (including cess) with indexation benefit. This benefit allows you to adjust the purchase price for inflation, potentially reducing your tax burden.

Gold ETFs and Gold Mutual Funds:

Similar to physical gold, these are taxed as follows:

Short-term: gains are taxed based on your income slab .

Long-term: Subject to a 20.8% tax (including cess). However, there’s no indexation benefit for these investments since 2023.

Sovereign Gold Bonds (SGBs):

Taxation on SGBs is a bit different:

Interest income: The annual interest earned on SGBs is taxable as per your income slab.

Capital gains (on maturity or sale): Exempt from tax if held till maturity (usually 8 years). Early redemption might attract capital gains tax depending on the holding period (similar to physical gold).

Remember: These are general guidelines, and tax laws can change. It’s always best to consult a tax advisor for the most up-to-date information on your specific situation.

BOTTOM LINE :

Gold has always been seen as valuable and stable. People like it because it’s rare and has a long history of being valuable. Putting some of your money into gold can be a smart move. It helps spread out your investments, so if one thing goes down, you don’t lose everything. This is important when the economy is uncertain. Knowing the different ways to invest in gold can help you make smart choices to keep your money safe and maybe even make more.

You can invest in gold in different ways. You have the option to purchase physical gold in the form of coins or bars. Another option is to invest in gold ETFs, which are like stocks that follow the price of gold. Gold mutual funds are also a way to invest in gold without owning the physical metal. Sovereign Gold Bonds (SGBs) are government-backed bonds where you get paid interest along with the chance to benefit from gold price increases. Each way has its pros and cons, so it’s important to do your research and choose what’s best for you.

Investing in gold can help you protect your money. When other investments like stocks or real estate are not doing well, gold often holds its value or goes up. It’s like having a backup plan for your money. By understanding the different ways to invest in gold, you can make informed decisions that will help you keep your money safe and maybe even grow it over time.