The Securities and Exchange Board of India (SEBI) has introduced a new mechanism for resolving disputes between investors and intermediaries in the securities market: Online Dispute Resolution (ODR). This system aims to provide a faster, cheaper, and more convenient way to settle disagreements compared to traditional methods.

What is ODR?

ODR refers to resolving disputes entirely online. Imagine it as a virtual courtroom where both parties can present their cases using a secure platform. The process involves a neutral third party, either a conciliator who facilitates communication and settlement or an arbitrator who delivers a binding decision.

Benefits of ODR for Investors

- Faster Resolution: ODR streamlines the dispute resolution process, potentially leading to swifter settlements compared to traditional court proceedings.

- Cost-Effective: ODR fees are typically lower than court costs, making it a more affordable option for investors, especially for smaller claims.

- Convenience: ODR allows for participation from anywhere with an internet connection, eliminating the need for physical appearances.

- Transparency: The ODR platform should provide a clear and transparent process for both parties.

Types of Disputes Handled Through ODR

The SEBI framework allows ODR to address a range of investor grievances related to the securities market, including:

- Issues related to dematerialization of securities (converting physical shares into electronic form)

- Delays in settlements or non-receipt of securities

- Incorrect debits or credits in investor accounts

- Failure to provide contractual services by intermediaries

- Refusal to redress investor complaints

How Does ODR Work?

The ODR process for the Indian securities market generally involves these steps:

- Initiating the Dispute: The investor files a complaint on the designated ODR platform, outlining the nature of the disagreement and the desired resolution.

- Responding to the Complaint: The intermediary receives the complaint and submits a response within a stipulated timeframe.

- Conciliation or Arbitration: Both parties can opt for conciliation, where a neutral third party attempts to guide them towards a mutually agreeable solution. If conciliation fails, they can choose arbitration, where the arbitrator delivers a binding decision.

- Settlement or Award: Ideally, the parties reach a settlement during conciliation. If not, the arbitrator issues a binding decision that both parties must abide by.

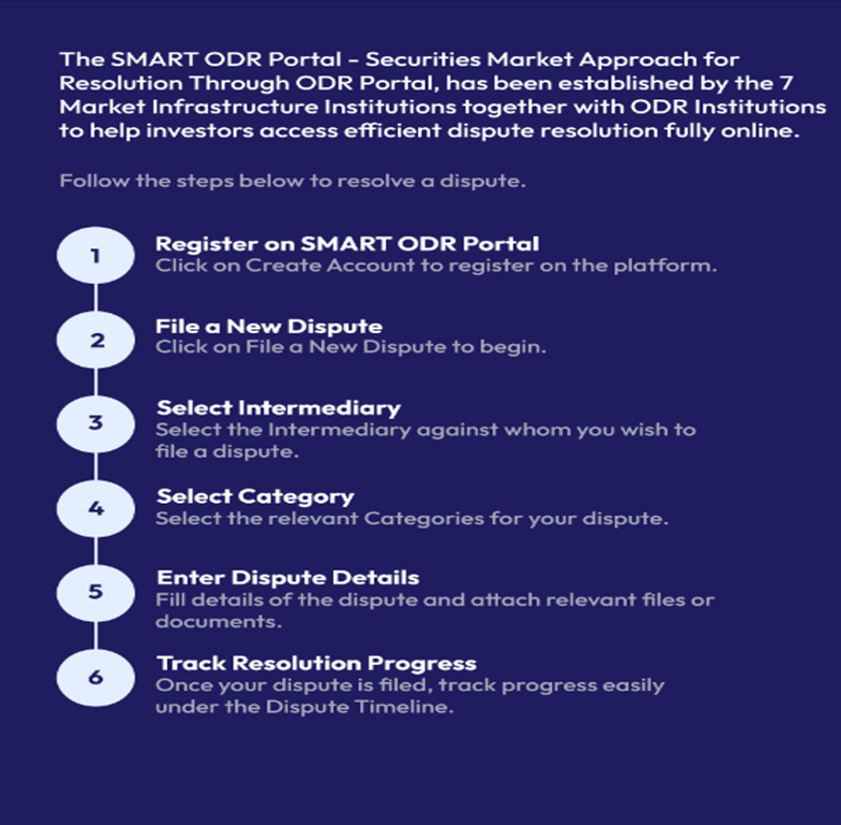

Applying for ODR in the Indian Securities Market

While the ODR framework is established, the specific functionalities for applying are still being developed by SEBI. The exact steps might differ slightly once the portal is live, but here’s a general idea of what the process might entail:

1. Check if your dispute qualifies:

- Make sure your grievance falls under the types of issues handled by ODR (refer to the FAQ section for details).

- You’ll likely need details about the intermediary involved and the nature of the disagreement.

2. Visit the ODR Portal :

- SEBI will launch a designated ODR portal where you can file your complaint.

- Keep an eye on SEBI’s website for updates on the portal’s launch date.

3. Register on the ODR Portal :

- You might need to create an account on the ODR platform using your PAN card or other relevant identification.

- This will allow you to track the progress of your complaint electronically.

4. File your ODR Complaint:

- Once registered, you’ll likely find a section to file a new complaint.

- The platform will guide you through the process, prompting you to provide details like:

- The name of the intermediary involved in the dispute.

- A clear description of the issue you’re facing.

- Any supporting documents you may have (copies of agreements, communication records, etc.).

- The desired outcome you’re seeking.

5. Submit your Complaint:

- Once you’ve filled out all the necessary details and attached any relevant documents, you can submit your complaint electronically.

- The ODR platform might provide you with a reference number for tracking purposes.

6. Wait for the Intermediary’s Response:

- The intermediary will receive your complaint electronically and will have a set timeframe to respond.

- Their response might propose a solution or provide further clarification on the issue.

7. Choose Conciliation or Arbitration:

- The ODR platform might offer you two options for resolving the dispute:

- Conciliation: A neutral third party will facilitate communication between you and the intermediary to try and reach a mutually agreeable solution.

- Arbitration: If conciliation fails, you can choose arbitration, where a neutral third party will make a binding decision that both parties must follow.

8. Follow the ODR Process:

- Depending on your chosen path (conciliation or arbitration), the ODR platform will guide you through further steps, which might involve:

- Exchanging communication with the intermediary through the platform.

- Participating in online meetings or discussions facilitated by the conciliator or arbitrator.

- Submitting additional information if required.

9. Resolution or Award:

- In the ideal scenario, conciliation will lead to a settlement agreement between you and the intermediary that resolves the dispute.

- If conciliation fails and you opt for arbitration, the arbitrator will issue a binding decision that both parties must abide by.

10. Post-ODR:

- The ODR platform might offer options to provide feedback on your experience with the process.

- Once the dispute is settled or an award is issued, you’ll likely be able to download or print a copy of the agreement or award for your records.

Important Note: This is a general guide based on the current ODR framework. The actual process might differ slightly once the ODR portal becomes operational. Keep an eye on SEBI’s website for official updates and detailed instructions.

SEBI’s Role in ODR

SEBI plays a crucial role in overseeing the ODR ecosystem:

- Establishing Framework: SEBI has issued circulars outlining the regulations and guidelines for ODR in the securities market.

- Empanelment of ODR Institutions: SEBI approves independent institutions with qualified conciliators and arbitrators to manage the ODR process.

Future of ODR for Indian Investors

ODR has the potential to significantly improve dispute resolution for investors in the Indian securities market. By offering a faster, cheaper, and more convenient alternative to traditional methods, ODR can empower investors to seek redressal for their grievances more effectively. The successful implementation of the ODR system will depend on factors such as user-friendly platform design, efficient dispute management by ODR institutions, and continued regulatory oversight by SEBI.

Online Dispute Resolution (ODR) FAQs for Investors

What is ODR?

- ODR stands for Online Dispute Resolution.

- It’s a process for settling disagreements between investors and intermediaries in the securities market entirely online.

What are the benefits of ODR for investors?

- Faster: ODR can resolve disputes quicker than traditional court proceedings.

- Cheaper: ODR fees are typically lower than court costs.

- Convenient: You can participate from anywhere with an internet connection.

- Transparent: The ODR platform should provide a clear process for both parties.

What types of disputes can be handled through ODR?

- Issues with dematerialization of securities (converting physical shares to electronic form).

- Delays in settlements or non-receipt of securities.

- Incorrect debits or credits in your investor account.

- Failure to provide services you were promised by intermediaries.

- Refusal by an intermediary to address your complaints.

How does ODR work?

- File a complaint: You submit a complaint on the ODR platform, outlining the issue and desired outcome.

- Intermediary responds: The intermediary receives your complaint and responds within a set timeframe.

- Conciliation or Arbitration: You can choose conciliation, where a neutral third party helps you reach a settlement. If that fails, you can choose arbitration for a binding decision.

- Settlement or Award: Ideally, you and the intermediary reach a settlement during conciliation. If not, the arbitrator issues a binding decision that both parties must follow.

What is SEBI’s role in ODR?

- SEBI sets the rules and guidelines for ODR in the securities market.

- SEBI approves independent institutions with qualified professionals to manage the ODR process.

Where can I find more information about ODR?

You can monitor SEBI’s website for updates on the launch of the ODR portal and any related information.