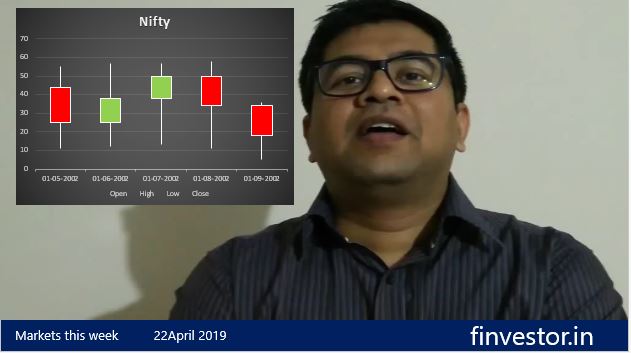

As we move into another week of election day, it is time we check the daily charts along with the hourly ones. The reason being, the market hit an all time high this week, and further movements can be determined if seen on a daily level in addition to the hourly charts.

On the daily level, the market went into a rangebound post the fall in Oct 2018, until 1st week of March 2019, from where the market started a new uptrend. This trend has not stopped – and the continuance of this trend will be key to handle the trades for this week. If you see the new uptrend, the Nifty has take support of the 9 day average, and never breached the 14 day average. So remember that for this week, if the market closes below the 9 day moving average, be cautious and keep off the market.

- Be cautious of the Nifty on the daily charts and keep an eye on the 9 and 14 day moving averages. We have had a long uptrend for some time.

- Use the daily 9 day average to enter into long positions with SL of the 14 day average.

Nifty calls

On the hourly charts, the market seems to be going into a downtrend – We can expect the market to go to the 11650 levels before making another attempt to scale the top. However, if the market opens positively on Monday, then long calls can be made.

- Sell if the 9 hourly average (EMA) crosses below 14 hourly average (EMA), SL and targets as per your risk profile.

- Enter into Long positions if the prices move up 11800.

Bank Nifty

Bank Nifty certainly looks much weaker than the Nifty, and we may see 29700 levels unless there is buying. It will be Bank Nifty that may keep Nifty from reaching all the highs this week.

- Sell for a target of 29700 levels.

- Buy only if the MACD shows positive reversals

Warning: Dealing with Futures and Options is considered highly risky and there is all possibility of losing the entire capital in a single day. The recommendations provided here are only for those who understand the risks of F&O. You must undergo a risk profiling before taking positions in F&O. Proper risk management – ie stop losses and money management is more important than just technical analysis.

All charts are screenshots from Zerodha, which is one of the best discount brokerage firms! Awesome tools in it.