The charts of automobiles were steadily falling downwards before COVID struck. Most of the listed stocks such as Tata, Maurti & M&M were slipping from their all time highs. Tata was sliding down. The Government was clueless, the automakers were trying to grapple with the changing dynamics and forecast the sales of electric mobility. And then came COVID19.

Sales of most car manufacturers were down by almost 50% with the lockdown solution to COVID19. However, post the lockdown, it appears that demand is back, perhaps to fill the backlog. Would new cars continue their pace?

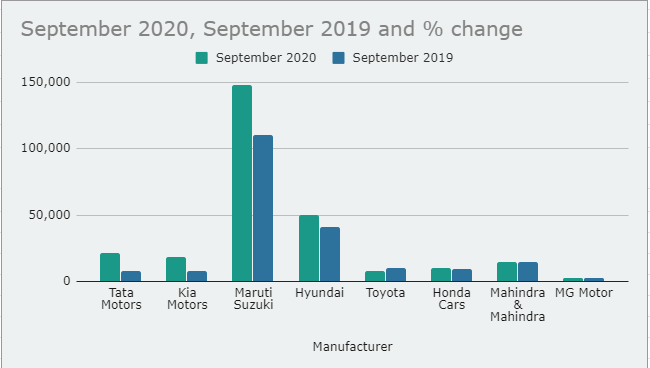

Let’s a look at the car sales reported

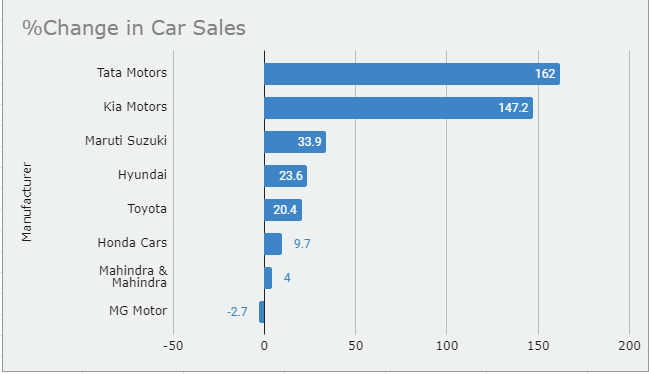

| Manufacturer | September 2020 | September 2019 | % change |

| Tata Motors | 21,199 | 8,097 | 162 |

| Kia Motors | 18,676 | 7,554 | 147.2 |

| Maruti Suzuki | 147,912 | 110,454 | 33.9 |

| Hyundai | 50,313 | 40,705 | 23.6 |

| Toyota | 8,116 | 10,203 | 20.4 |

| Honda Cars | 10,199 | 9,301 | 9.7 |

| Mahindra & Mahindra | 14,857 | 14,333 | 4 |

| MG Motor | 2,537 | 2,608 | -2.7 |

Maruti continues to dominate, from sales, but what is a comeback is Tata Motors. With new car launches and plan of better dealership experience, it has been able to garner better sales even during this pandemic. What is not a surprise is Kia Motors piercing the sales of others, and perhaps even taking a lot from Nexon – in its newly launched Sonet.

Can we expect the car sales to continue increase? With most of the services sector doing work from home, many have already deferred plans for a new car, even if the car offers are tempting. The only reason, personally, should be to explore new age cars like electric mobility for the adopters, or if the car is really old (7+ years and used extensively).

From a stock point of view, the prices of Tata, Maruti and M&M are still lower. Any further uptick in the car sales may revive these stocks. Accumulation can be planned, as these are companies that will be in India for longer term.