Equity Linked Savings Scheme or popularly know as ELSS Funds are tax-saving equity mutual funds. While ELSS may not be always needed to save tax as your PPF and EPF and Insurance premiums will surely cover the 1.5L. However, there are cases when you may want to invest in ELSS as it saves tax along with investment in equities, whose returns are expected to be higher than fixed deposits.

ELSS funds are essentially equity funds that invest a major portion of their corpus into equity or equity-related instruments. ELSS funds offer tax exemption of up to Rs. 150,000 from your annual taxable income under Section 80C of the Income Tax Act. Further, the income that you earn under this scheme at the end of the three-year tenure will be considered as Long Term Capital Gain (LTCG) and will be taxed at 10% (if the gain is above Rs. 1 lakh).

There are ways to extract the most out of an ELSS investment. In case you have already invested in ELSS and want to continue in an ELSS, but do not have additional cash to put in, you may want to try out the rollover strategy which is quite popular. Rollovers are not just limited to ELSS investment, but used in any investment that have a lockin-period and can be withdrawn and invested the same day. There are cases Life Insurance Policies, esp that have a money back scheme – which to me is an extremely bad financial idea.

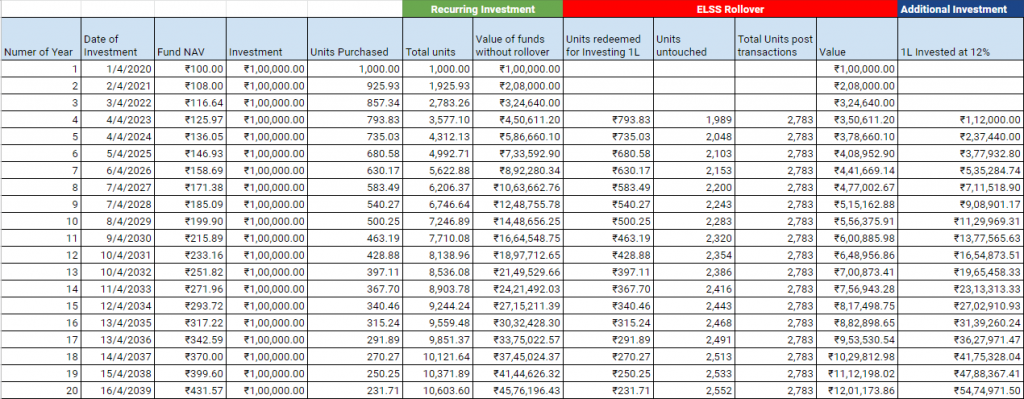

The ELSS strategy can be illustrated is as below:

- Year 2020 – invest ₹1,00,000 in ELSS A

- Year 2021 – Invest ₹1,00,000 in ELSS A

- Year 2022 – Invest ₹1,00,000 in ELSS A

- Year 2023 – the ₹1,00,000 in ELSS A in 2020 has grown to say ₹1,10,000. So you withdraw ₹1,00,000 and reinvest back in ELSS A. No long term capital gains tax since less than or equal to ₹1,00,000.

- Year 2024 – the ₹1,00,000 in ELSS A in 2021 has grown to say ₹1,05,000 . So you withdraw ₹1,00,000 and reinvest back in ELSS B. No long term capital gains tax since less than or equal to ₹1,00,000.

- Year 2025 – the ₹1,00,000 in ELSS A in 2022 has grown to say ₹1,15,000. So you withdraw ₹1,00,000 and reinvest back in ELSS C. No long term capital gains tax since less than or equal to ₹1,00,000.

The only problem in a rollover is that when the value after 3 years falls below ₹1,00,000, which is your target, but that can be anyway a variable.

This strategy works great if you have say a fixed amount for ELSS planned to be invested every year. Let us try to see how much of benefit can this actually provide. Let us assume that the ₹1,00,000 invested in ELSS is for someone in the highest tax bracket of 30% and remains so in the future years.

The key point in the rollover strategy is that once the 3 years investment is over, you do not need to put additional amount in ELSS, and still able to get the tax benefits and reap growth benefits assumed with equity based funds.

Assumptions – ELSS gives a return of 8%.

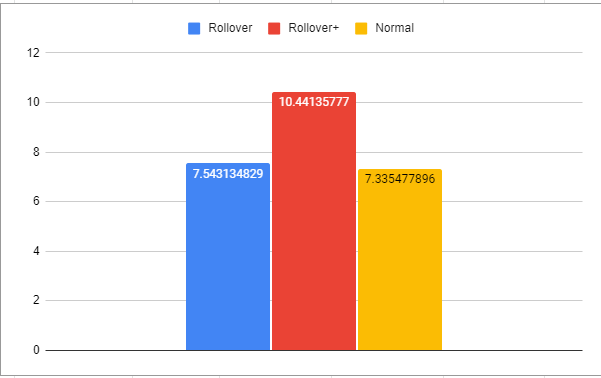

If you continue to invest in an ELSS that gives an assumed return of 8%, you will get ₹ 33L after 20 years.

If you do the rollover strategy, you get just ₹7.3L over 20 years.

However, what is important is that you would have saved ₹5.1L of tax by just your initial investment of ₹3L, which is significant. Of course, if you take the XIRR comparison, which shows both ELSS and ELSS+Rollover giving the same XIRR as the money grows at 8% (assumed).

Also, note that the ₹1L saved can be invested in a more aggressive fund and you can get ₹53L from the saved ₹1L (assuming that gives 12% returns).

If someone asks me, as a SEBI RIA, I would not advice such complicated ways of investment as it only creates a lot of academic studies for ELSS. My suggestion is always use PPF, EPF, SSY (if applicable) to fill up the 80C, before thinking about ELSS. Equity mutual funds are best when they invested with diversified funds and can be then redeemed without any tax objectives.