The correction in global equity markets as a result of growing fears of a new COVID-19 variant in South Africa and the resurgence of COVID-19 cases in several European nations, rising expectations for rate hikes in the US amid inflationary pressures, large selling by FIIs due to concerns about overvaluation and the likelihood of a Fed rate hike, and the government’s decision to repeal farm laws all contributed to market selling pressure.

The Nifty50 fell 738.35 points, or 4.16 percent, to 17,026.45, its lowest close since August 30 this year, while the BSE Sensex fell 2,528.86 points, or 4.24 percent, to 57,107.15, as selling was observed across all sectors except Pharma.

The broader markets were also under pressure, with the BSE Midcap and Smallcap indices declining 4.14 percent and 2.52 percent, respectively.

Experts believe the uneasiness will likely persist throughout the coming week as well, with a greater emphasis on the severity of the new COVID-19 version, monthly auto sales statistics, second-quarter GDP data, and FII flow.

The market is expected to remain under pressure until more clarification emerges regarding the potential risk of this new COVID-19 variation and the timeframe of the Fed raising interest rates.

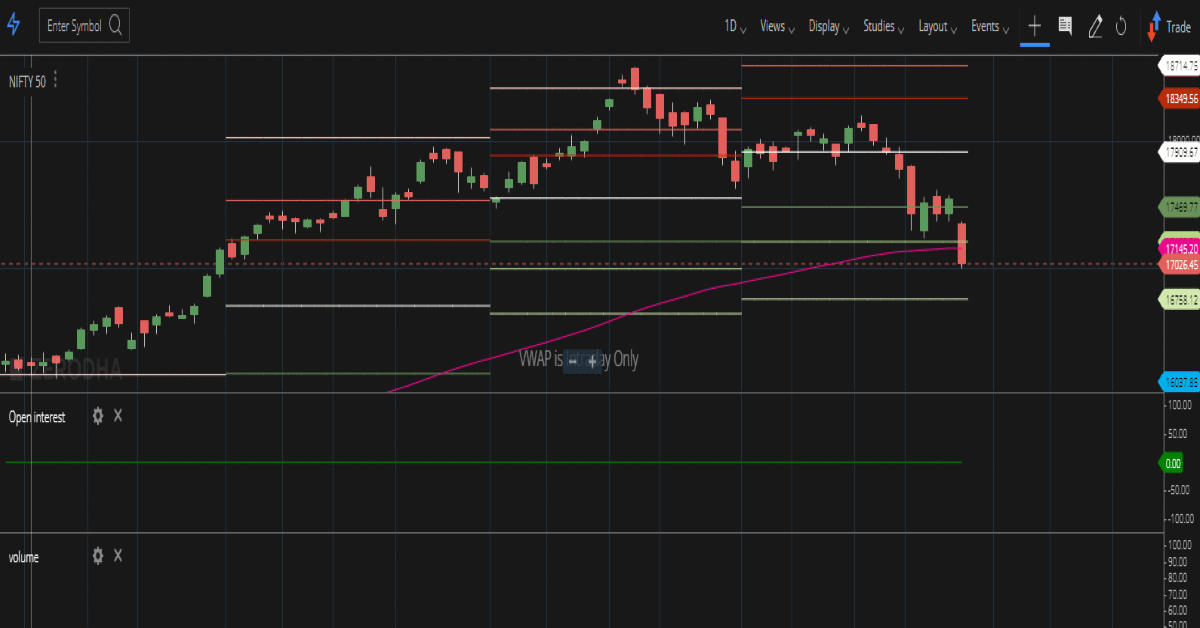

A Technical Perspective

The Nifty50 formed a strong bearish candle on both the daily and weekly charts following a Black Friday that saw the index decline nearly 3% to 17,026 for the week, indicating overall negative sentiment and volatility in the coming week. Experts believe that 17,000 will be critical for further correction or rebound.

“According to the Fibonacci retracement, the Nifty has retraced 50% of the rise from July to October. There is a slight possibility of a recovery from this support zone as long as the index closes above the 17,000 level. On the other hand, a close below 17,000 may cause the Nifty to fall towards the 61.8 percent retracement level near 16,650.

Coronavirus

India has seen a steady decline in daily case additions over the last couple of weeks, reporting less than 11,000 cases daily, but the resurgence of COVID-19 cases in several European nations, prompting the implementation of new COVID-19 restrictions, and the discovery of a new COVID-19 variant in South Africa, forcing several nations to close borders, has reignited global concern, bringing forward uncertainty about these countries’ growth prospects. Not just in South Africa, but also in Hong Kong, Belgium, Israel, and Botswana, new COVID-19 variant instances have been identified.

Vaccination in India has been proceeding well, with over 121 crore COVID-19 doses provided thus far, with more than 35% of people receiving second COVID-19 doses.

FII Action

The FII selling accelerated in November, owing to valuation concerns and growing expectations of faster rate hikes in the US if inflation continues to rise. Even DIIs were unable to mask the FIIs’ selling quantum. As a result, it will be closely monitored.

Foreign investors sold shares worth more than Rs 21,000 crore in the last week, bringing the total monthly selling to more than Rs 31,000 crore in November, on top of more than Rs 25,000 crore in October. On the contrary, domestic institutional investors have net purchased about Rs 11,000 crore of shares, and their purchases in November totaled over Rs 20,000 crore, up from Rs 4,470 crore in October.

Automobile Sales

November auto sales will be closely monitored, as the chip shortage issue is likely to weigh on passenger vehicle (PV) sales growth, while volumes may rise month over month. Experts believe that two-wheeler and tractor sales may also drop, although commercial vehicle (CV) sales may improve. As a result, companies such as Bajaj Auto, Hero MotoCorp, Maruti Suzuki, Tata Motors, Eicher Motors, and M&M would be highlighted.

Initial Public Offerings and Listings

The primary market will stay active this week, as Go Fashion, the owner of women’s bottom-wear company Go Colors, will have its initial public offering on November 30. The issue price has been set at Rs 690 per share in its final form.

The Star Health and Allied Insurance Company, which is backed by ace investor Rakesh Jhunjhunwala, will begin accepting subscriptions for its Rs 7,249-crore initial public offering on November 30 and will end on December 2. The offer price band has been set at Rs 870-900 per share.

Tega Industries, the world’s second largest manufacturer of polymer-based mill liners, will also undertake a Rs 619-crore initial public offering (IPO) in the following week, December 1-3, 2021, with a price band of Rs 443-453 per share.

Prices of Crude Oil

Oil prices fell sharply this week, particularly on November 26, as additional COVID-19 variant instances fueled fears of a demand slowdown as supply increased. Several major economies, including the United States and China, have opted to release some of their reserves in order to bring international markets’ prices down.

Brent crude futures, the international benchmark for oil prices, have fallen more than 13% from their recent peak and approximately 3% this week. While falling oil prices are beneficial for countries like India, which is a net oil importer, experts believe that excessive volatility could pose a risk to the country.

Economic Statistics

On November 30, the gross domestic product (GDP) figures for July-September 2021 will be announced, as will the infrastructure output and budget deficit figures for October. GDP growth for the quarter is projected to be between 7.5-9 percent, experts believe, down from the 20.1 percent pace witnessed in Q1FY22 due to a low base effect.

The November Markit Manufacturing PMI will be issued on December 1, while the November Markit Services & Composite PMI will be released on Friday.

On November 26, the deposit and bank loan growth for the two weeks ended November 19, as well as foreign exchange reserves for the week ended November 26, will be announced.

Cues for F&O

The option data showed that the Nifty might trade in a greater range of 16,500-17,500 levels in the next days, but the increase in volatility is definitely a cause for concern and favours bears, according to experts.

On the option front, the maximum Call open interest was seen at 17500, followed by 18000 and 17300 strikes, and Call writing was seen at 17300, followed by 17500 and 17400 strikes, while the maximum Put open interest was seen at 17000, followed by 16800 and 16300 strikes, with Put unwinding at 17500, 17400, and 17300 strikes.

On a weekly basis, the India VIX increased by 40% from 14.86 to 20.80.